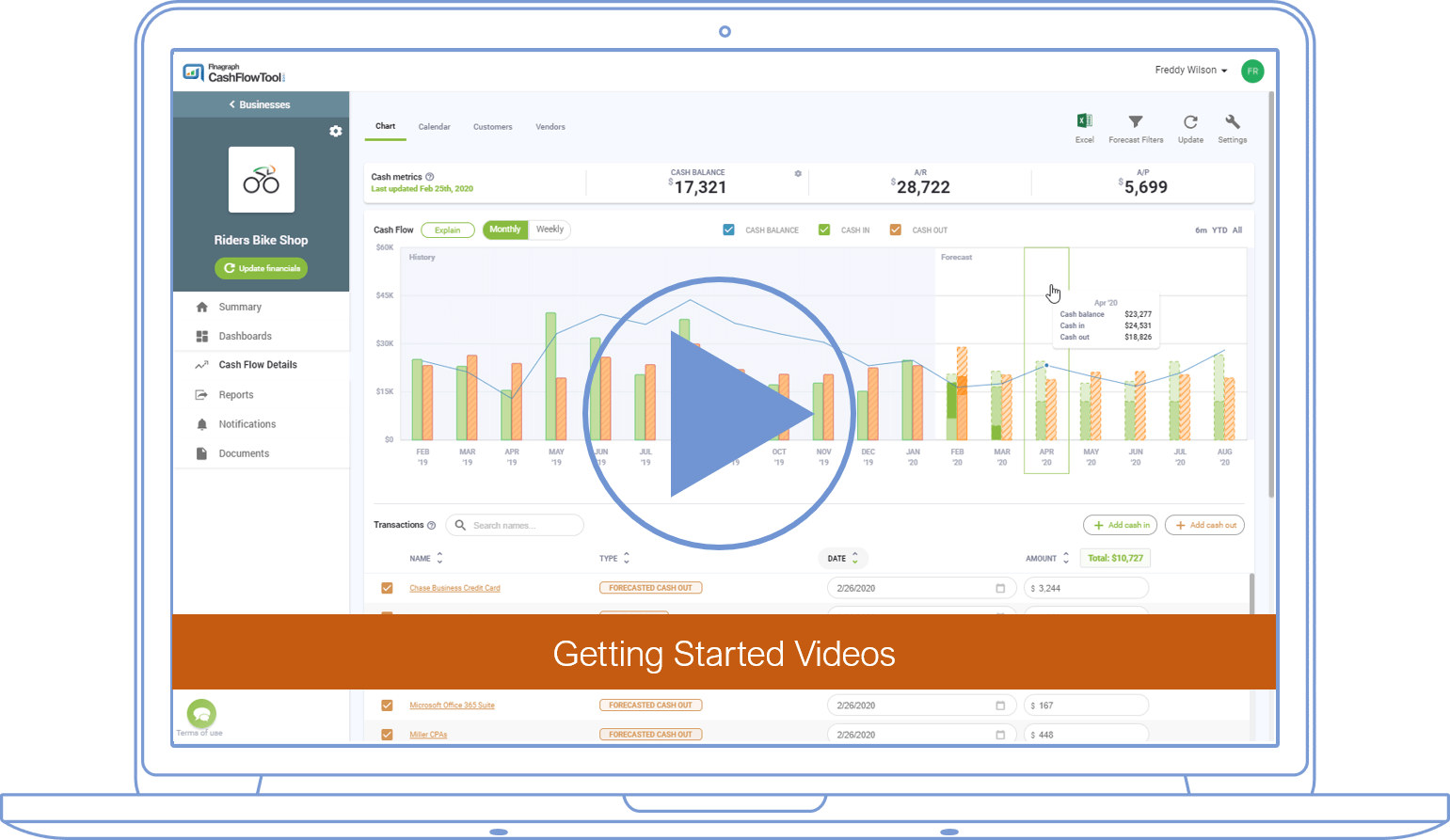

Product Demos

CashFlowTool Lite Demo

See CashFlowTool Lite in action.

CashGuardian™ Demo

Learn how CashGuardian™ watches over a business.

Learn more about CashGuardian™ and the Summary screen in CashFlowTool.

CashFlowTool Pro Demo

Learn how a small business can benefit from CashFlowTool Pro.

CashFlowTool Demo for Accountants

Learn how accountants can benefit from CashFlowTool.