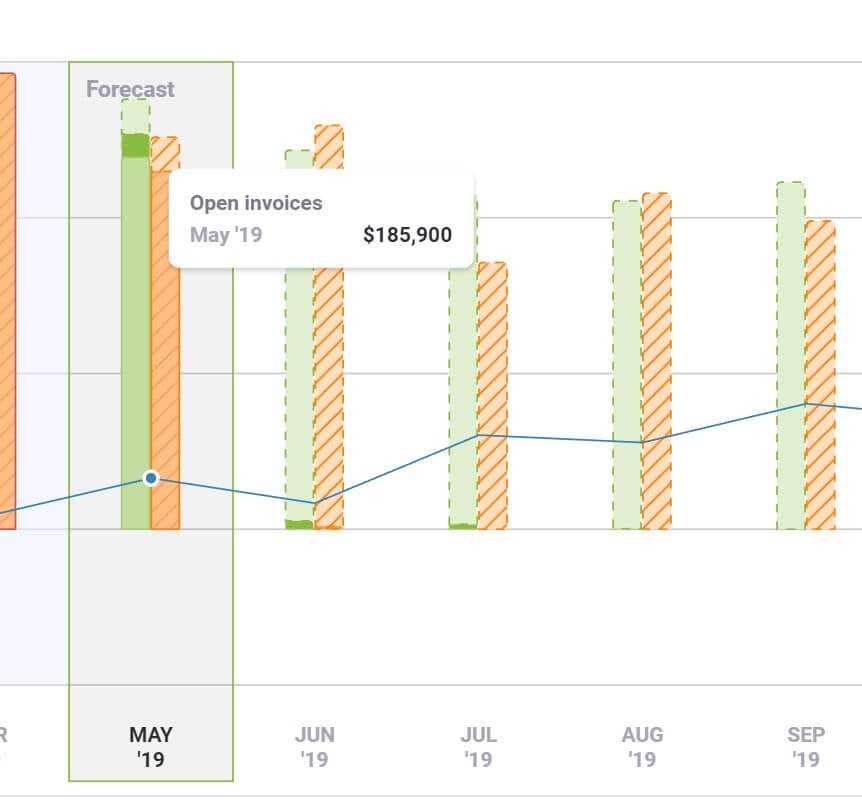

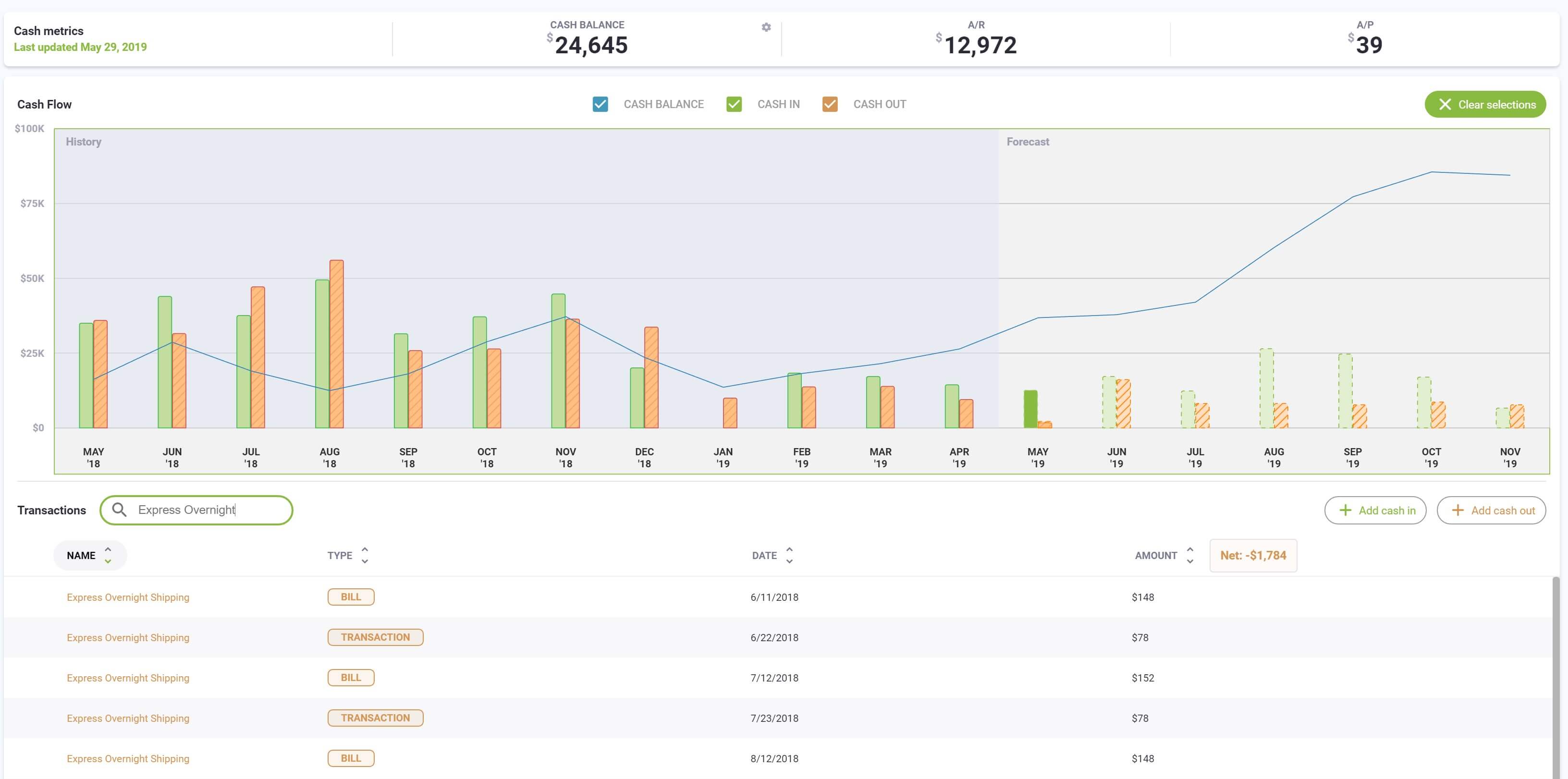

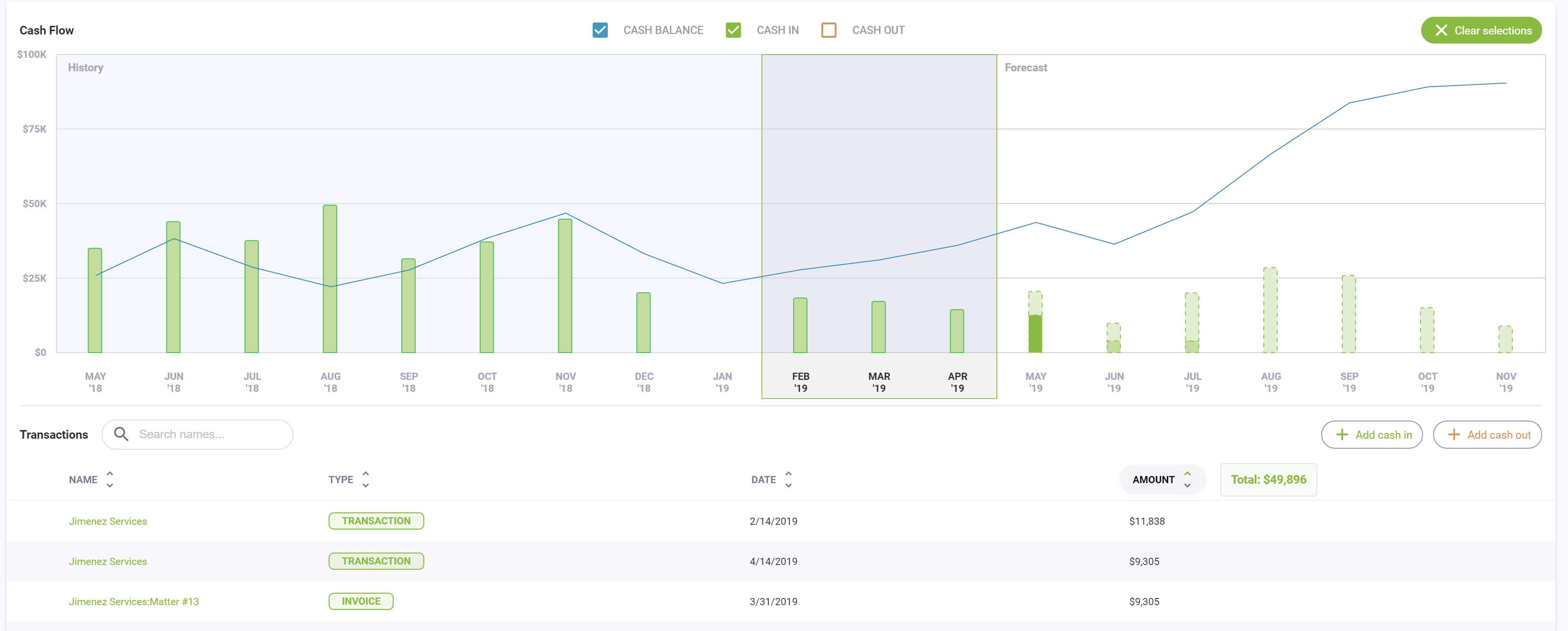

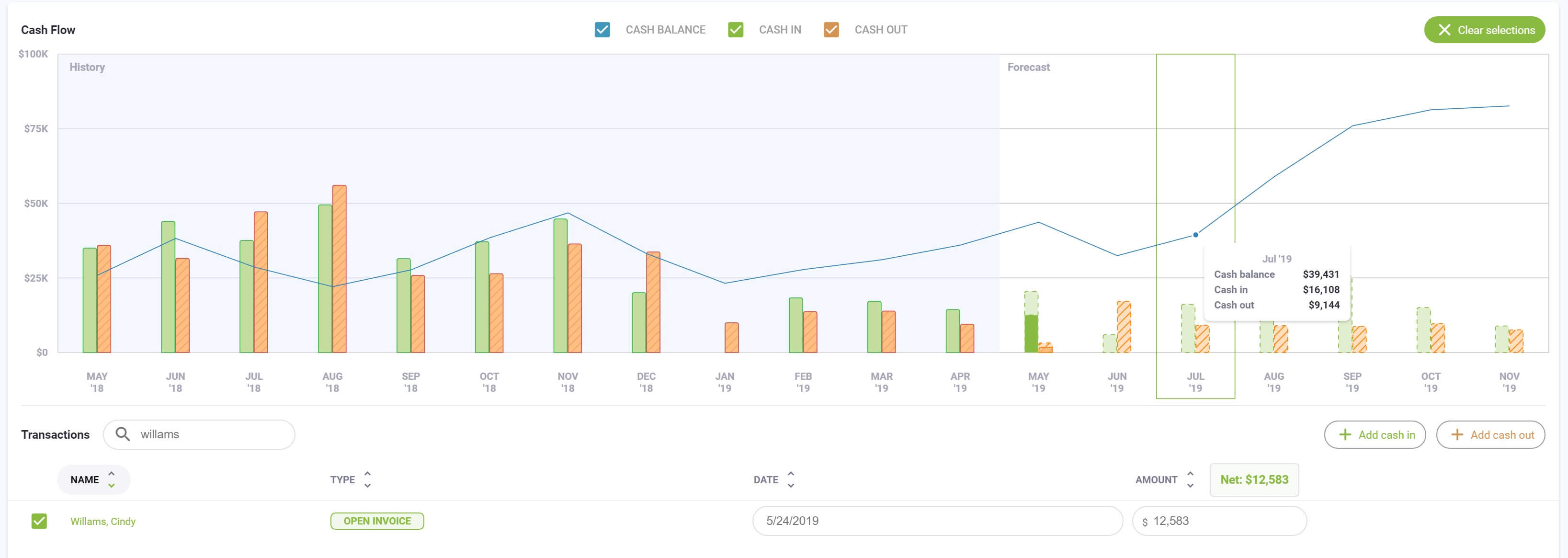

Interactive Chart

CashFlowTool’s interactive chart gives you the ability to select one or more months directly on the chart and see a total of your net cash plus all of the specific transactions for the selected months. Use the chart to view transactions for one or more months by simply selecting the month on the chart and select multiple months by togging individual months on and off.

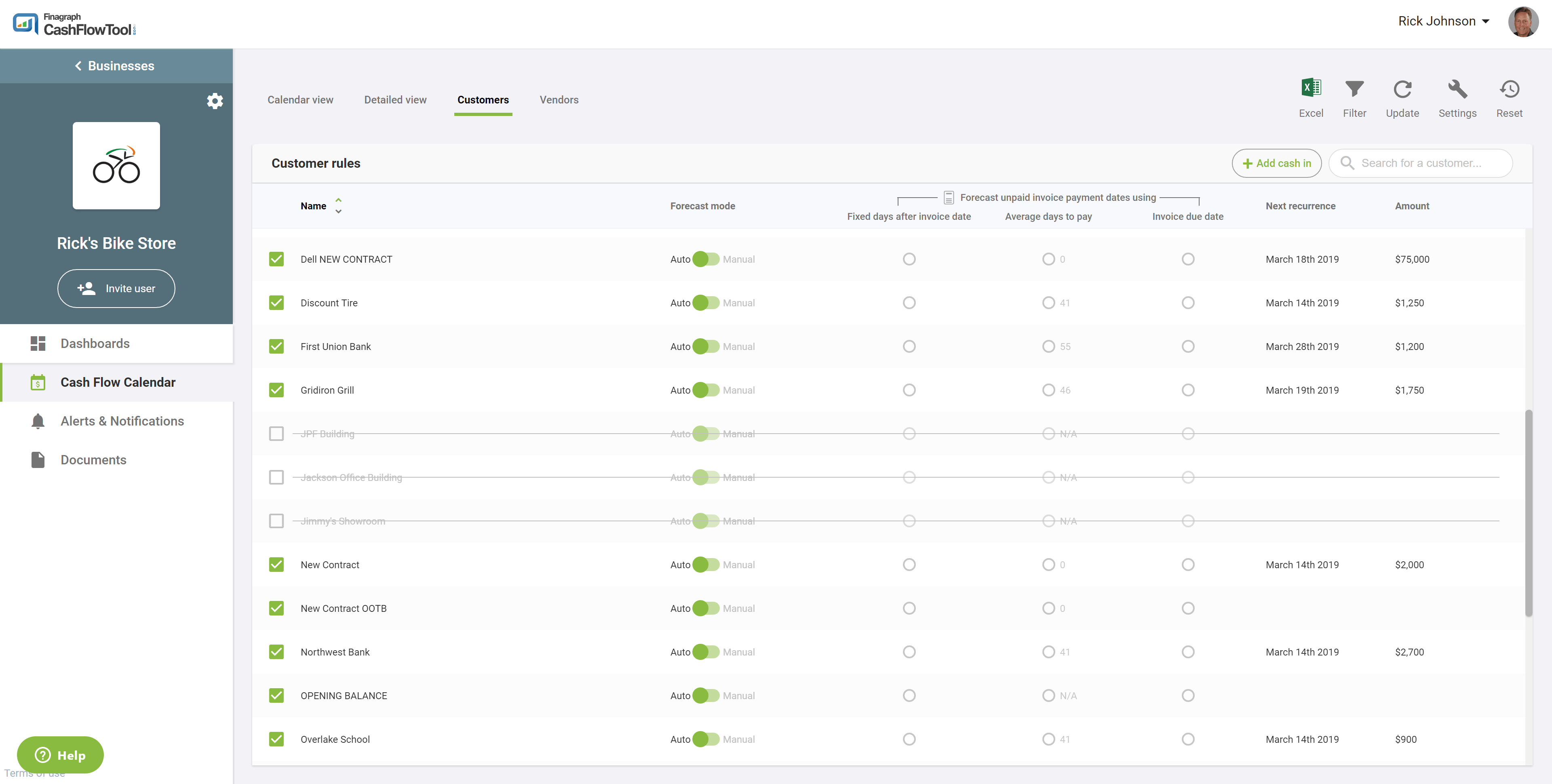

Invoice & bill payment rules

CashFlowTool uses CashLearn to automatically predict when future invoices will be paid and their amount based on analyzing past transactions. Depending on the nature of your business there maybe times where you want to override the forecasted payment date for an invoice.

Invoice Payment Date Rules are helpful when:

- You want to always exclude a customer or vendor from the cash flow calendar.

- You have setup a recurring payment with your bank and know the exact day the invoice will be paid each time.

- Your customer has a contractual agreement to pay by a specific day.

- You want to view your cash flow forecast assuming the invoice is paid a fixed number of days after the invoice date or on the invoice due date.

- The actual payment date is erratic and you want to view you cash flow calendar assuming the customer pays on-time.

Unpaid Invoice Payment Date Rules allows you to specify how unpaid invoices payment dates should be forecasted. You should use these settings when you want to always exclude a customer or vendor from your cash flow forecast or you have specific knowledge about a customer or vendor and want to override the CashLearn’s predictions.

From the Cash Flow Calendar view, two new tabs are available, Customers or Vendors you will be able to:

- See lists of known customers or vendors based on looking at the last 12 months of transactions.

- Indicates if the customer or vendor should be included in the forecast.

- Set unpaid invoice payment forecasting rule

- View next recurrence date and amount

When checked, the customer or vendor will be included in the cash flow forecast. Uncheck customers or vendors that you want to exclude from the forecast.

Forecast modeAuto (default)

Manual

Uses CashLearn to automatically predict the payment date

Predicts using rules setting

Fixed days

Average days to pay

Invoice due date

Uses the fixed days after the invoice date. If selected, you can specify the number of days.

Uses the average number of days to pay based on invoiced date.

Uses the actual invoice due date.

The customer and vendor list are generated from the last 12 months of transactions vs. reading the customer and vendor list from QuickBooks. This ensures that all customers or vendors are listed even if the customer or vendor is no longer listed in QuickBooks.

After you save your changes, the rules are automatically applied to the cash flow calendar and used every time you update your finances.

.jpg)

.jpg)