With the Covid-19 crisis affecting businesses everywhere, you probably have experienced a drop in income. In this blog we will discuss how you can review and forecast your future income and combined with the expense planning, you will effectively know your complete cash flow picture.

Knowing your future income with some level of certainty is essential in running your business. It determines what level of expenses you can support, whether you can make payroll or rent and helps you decide how you invest in the future of your business. This process is directly related to your expenses evaluation and you need to perform both together to ultimately make decisions on your cash flow.

|

|

|||

|

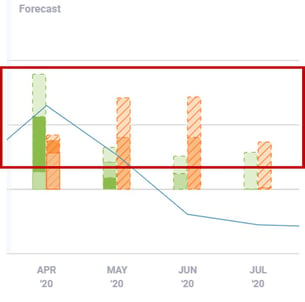

Step 1: Setup your active (cash in) active monitoring system |

|||

| The first quick thing you should do is setup a dashboard inside of CashFlowTool to consistently monitor your cash in and factors that contribute to this. Add a dashboard called "Cash in monitoring" and add the following cards: - Overdue customer invoices - Cash on hand - Days cash on hand - Monthly sales - Average days to collect from customers - Cash shortage. |

|

||

| Step 2: Forecast future income for 30/60/90 days | |||

|

Next, jump into CashFlowTool and go into the Cash Flow Details. Turn off Cash out at the top of the chart so you are focused on just the income (cash in). Now select the next month (eg April) and note the amount of your total income for the next 30 days. Select May in the chart and note the amount for both April & May (60 days). Finally, select June and note the amount for April - June (90 days). These totals are the total amount of forecasted income that you are projected to have over this period. Now that you know your income for the next 30/60/90, let's go to Step 3 and see where the income is coming in and who you are most dependent upon. |

||

|

|

|||

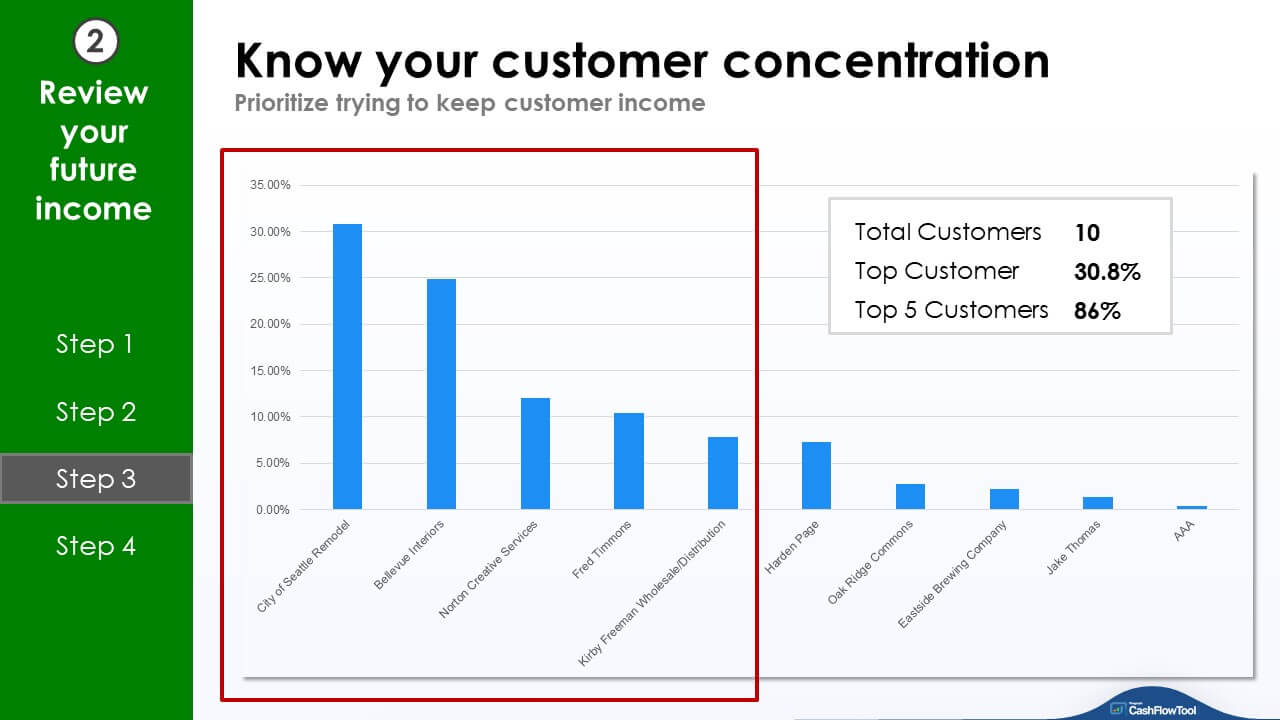

| Step 3: Know your customer concentration | |||

|

As a small business owner, you always want to understand the dependence you have on your customers and what happens if you lose one or more. Using the export to Excel feature in Excel, you can see all of your future income and sources of income and create a customer concentration list by doing the following: 1. View all of your customers and quickly total up their 90 day revenue amounts for each Once you have done this, you instantly know how important the top customers are and you can plan on doing whatever you can to keep them which we will discuss in Step 4.

|

|

||

|

|

|||

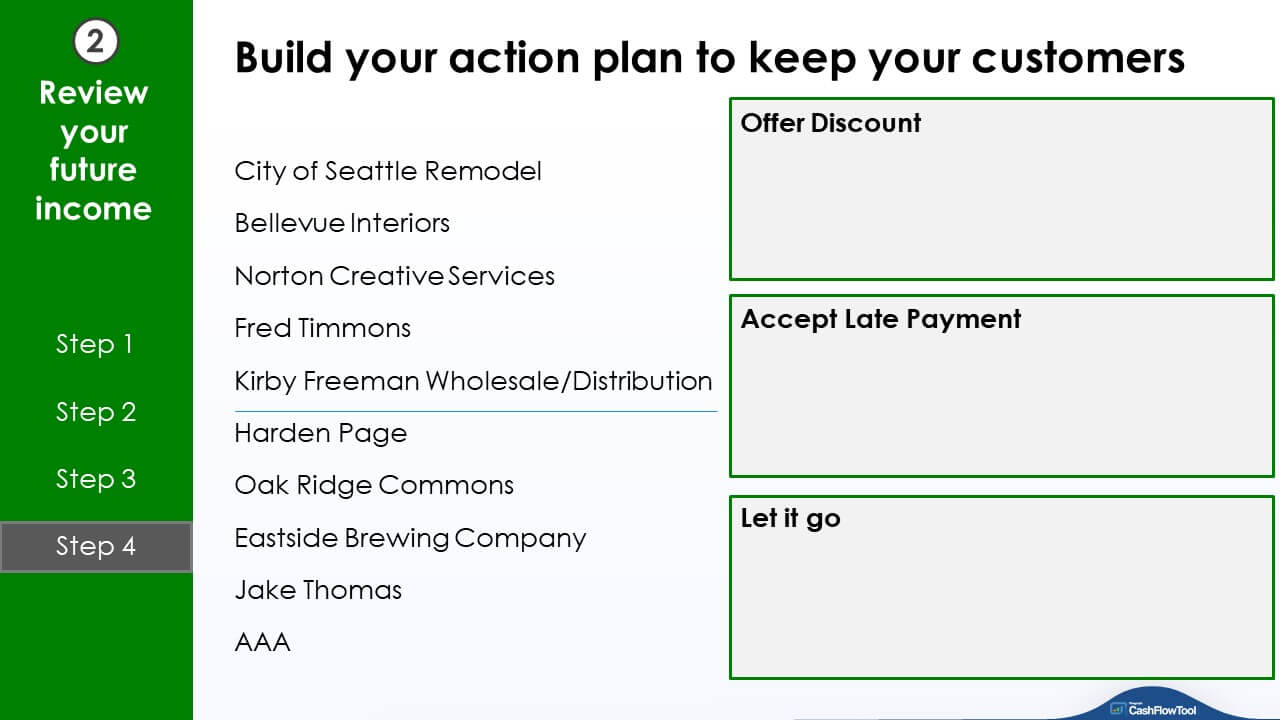

| Step 4: Build your action plan to keep your customers | |||

|

Since you have created your customer concentration list, you now need to decide what steps you take to keep them. We have created 3 options (you may have more) that enable you to put an action plan in place for each customer: Offer a Discount: Call your top customers and find out where they are at. Can you keep them at full price or can you offer them a discount to keep them? Accept late payment(s): Offer to let them pay you later. This is a good option because you keep them as a customer. Let them go: By doing the customer concentration step, you see that your bottom-list customers probably don't materially impact your overall revenue and as such, if you lose them, it is not a significant impact to your business. You want to spend all your time keeping the your top customers and if you have time, then start addressing the remaining ones.

Once you have finished these steps, you can now go into CashFlowTool and model all of the changes. You will have reached out to all your customers and know where they stand.

|

||

Other Resources:

Blog: Evaluate-your-expenses-now

Blog: Stress Test your P&L

Blog: Calculate & Forecast your cash burn rate

Blog: Perform cash break-even analysis

Our Covid-19 "Help my Business" Resource Center

Have questions? Email the CashFlowTool team