With the Covid-19 crisis affecting businesses everywhere, it is now more important than ever to manage and plan your cash flow. It starts with a methodology of evaluating your expenses immediately.

Evaluating your cash flow during this crisis starts with looking at both your current and future expenses as well as your future income. Both are clearly interrelated where your income enables you to afford more expenses, but if you are like many businesses during this crisis, your income has dropped. So in this blog article and video, we will show you a methodology of how to evaluate your expenses to determine which ones should be eliminated right away and which ones you need to keep.

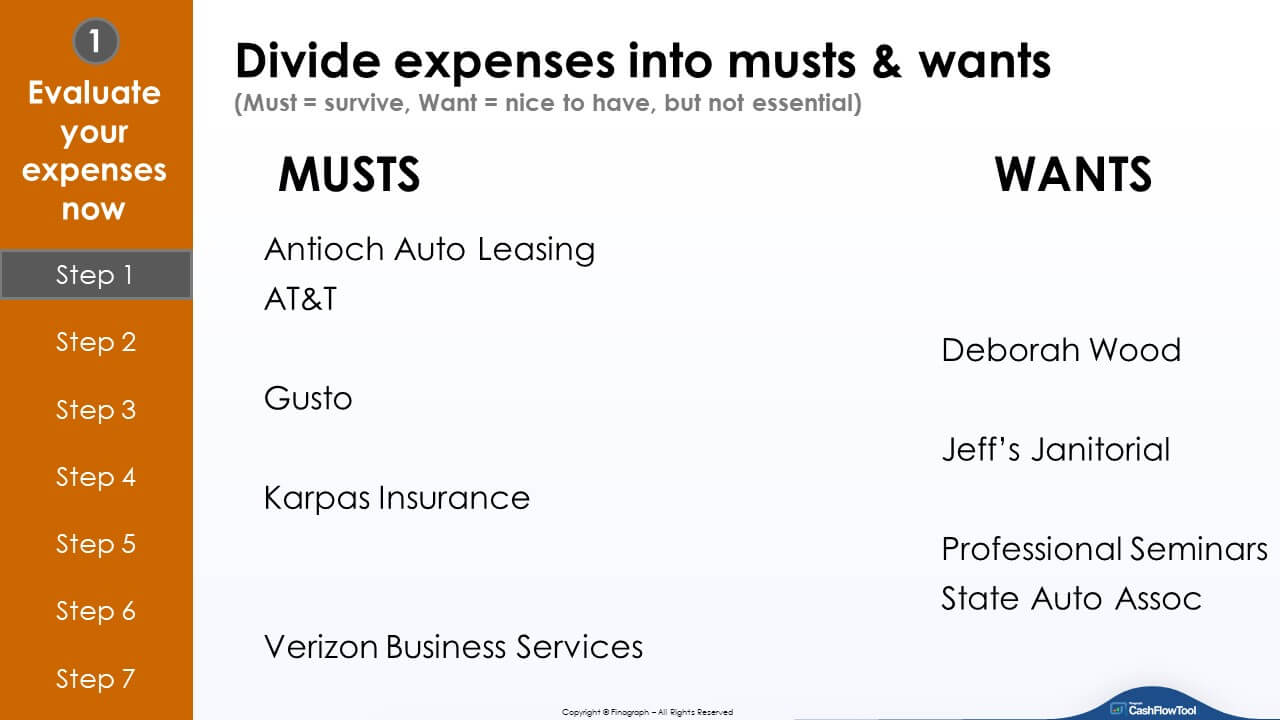

| Step 1: Divide your expenses into Musts & Wants | |

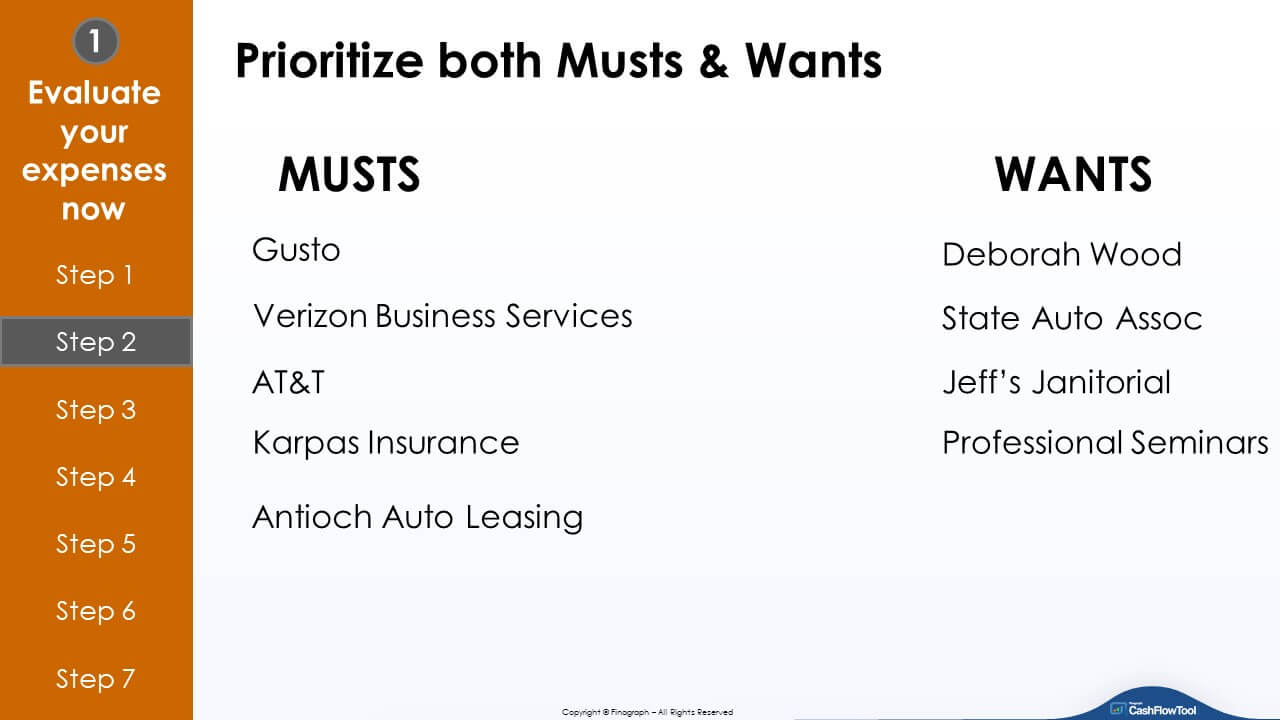

| The first thing we all do when we see a drop in income is to just cut the biggest expenses so you are not bleeding cash. This may not be the wisest way to cut expenses. So before you do that, simply divide the expenses into "musts" and "wants". The "must" expenses are those that you must have to keep your business running. The "wants" are those that are nice to have (in the good times), but not essential. |

|

| Step 2: Prioritize both the Musts & Wants | |

|

Now quickly prioritize the musts and the wants. In this example, we have prioritized Gusto (payroll) as the #1 must because we want to do everything we can to keep our payroll. In deciding this prioritization, you should also factor in the amount of the expense as clearly this matters. |

|

|

|

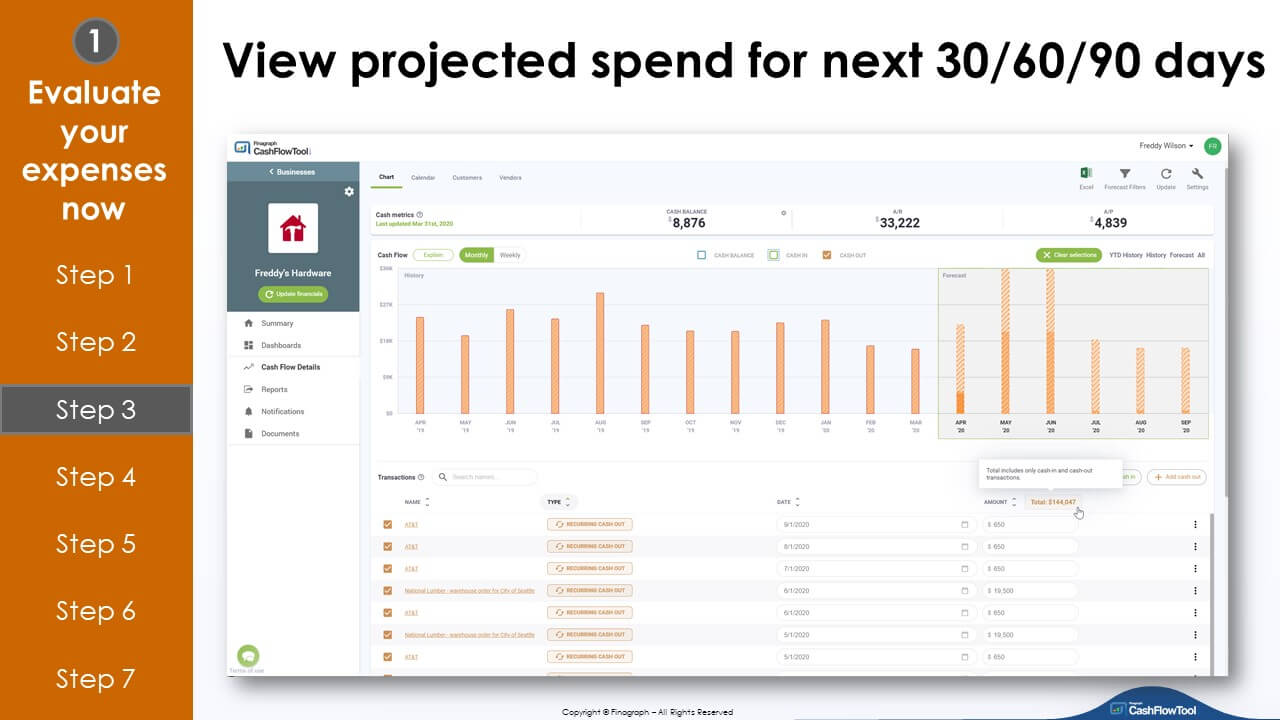

| Step 3: View projected spend for next 30/60/90 days | |

| Next, jump into CashFlowTool and go into the Cash Flow Details. Turn off Cash In at the top of the chart so you are focused on just the expenses (cash out). Now select the next month (eg April) and note the amount of your total expenses for the next 30 days. Select May in the chart and note the amount for both April & May (60 days). Finally, select June and note the amount for April - June (90 days). These totals are the total amount of forecasted expenses that you are projected to have over this period. Now that you know the amount totals, and divided your expenses into musts and wants, you are in a position to decide what you can cut. |

|

|

Step 4: Quickly see the impact of the wants on your cash flow |

|

|

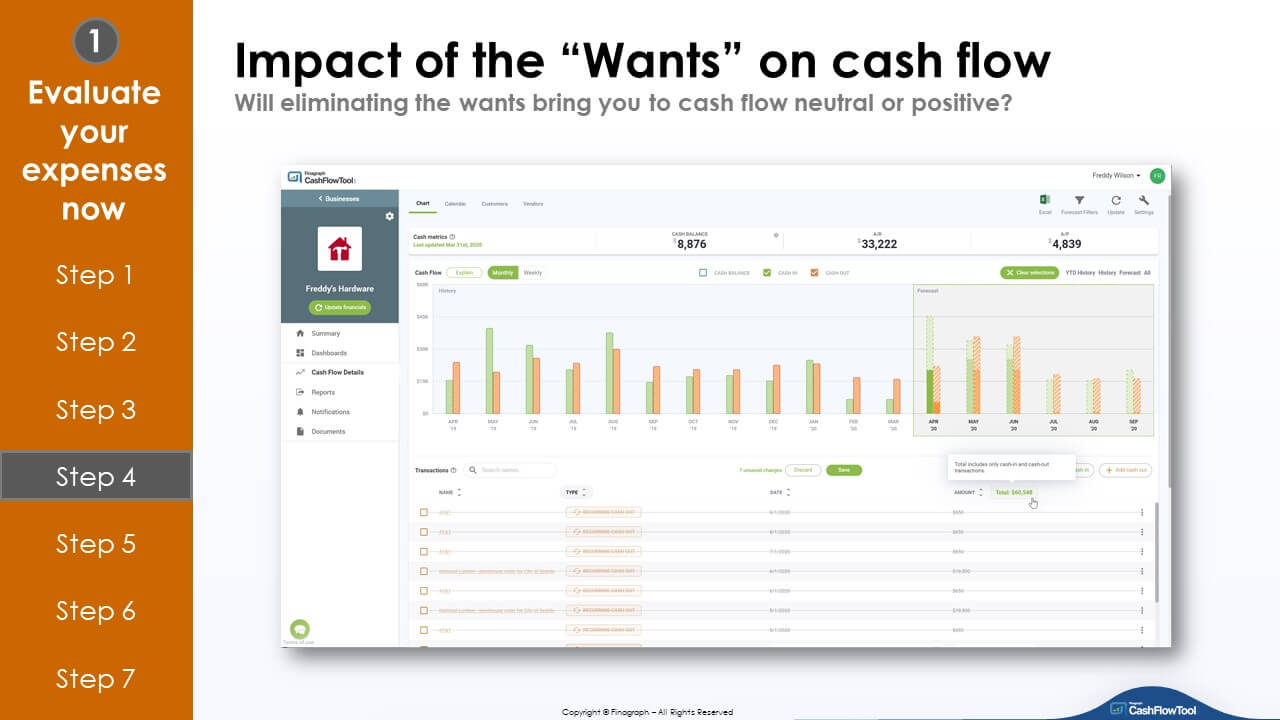

Now that you have your prioritized list of expenses, let's see the direct impact on your future cash flow by temporarily turning them off. In CashFlowTool, go back to the chart in Cash Flow Details, turn off Cash In at the top of the chart and then find each of your must expenses and uncheck them. Once done, re-select Cash In at the top of the chart and you will see the direct impact on your cash flow. Look carefully to see if you created a net-positive cash flow for the next 30-60-90 days. If you did, then you are off to a great start although we still need to see the impact of income going down. If you haven't created enough of a cash "cushion" then you will need to go to step 5 below. |

|

|

|

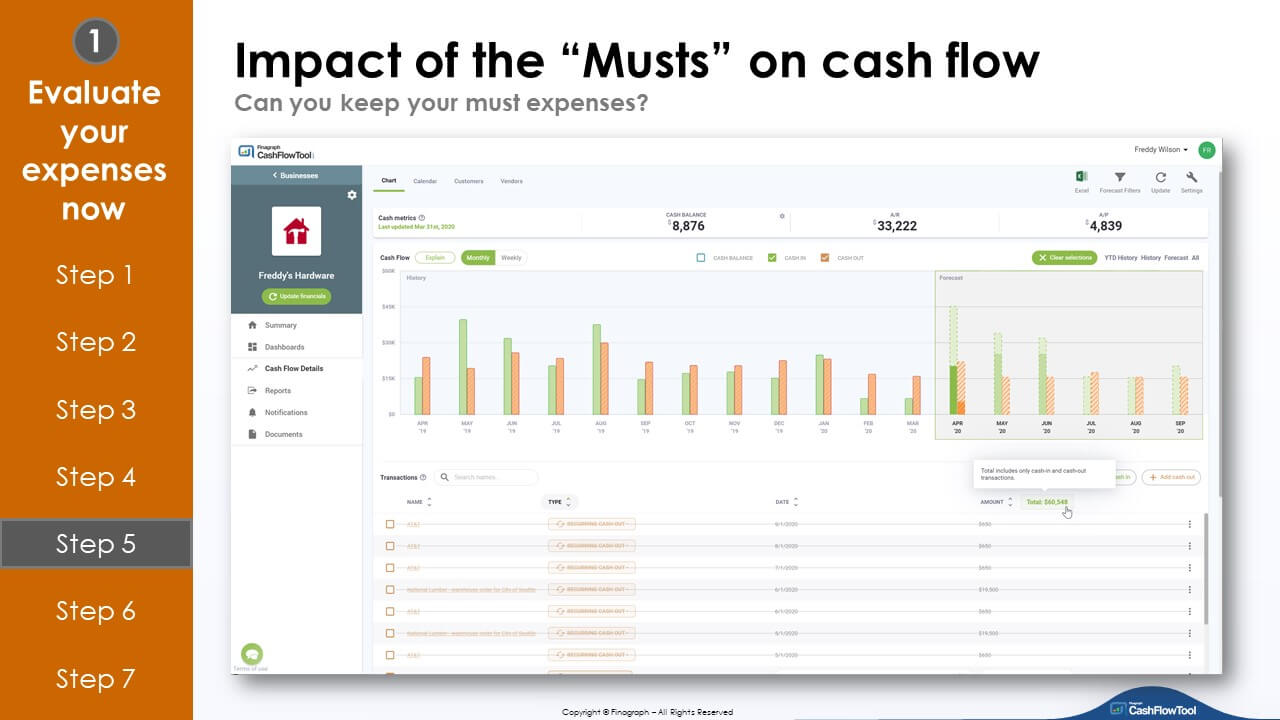

| Step 5: Evaluate the impact of the musts on your cash flow

|

|

|

This is virtually identical to what you did in step 4, but now with your must list of expenses. If you created a big cushion anticipating a drop in income in step 4, then good job. But if not, you may need to make deeper cuts. Re-look at your prioritized musts list and start at the bottom working your way up to assess how much you may need to cut. Remember, these expenses that you temporarily turn off are just that, temporary and you can always turn them back on. The advantage is that you can immediately see the impact to your cash flow. Before you actually turn off (cut) your musts (and possibly wants) expenses, let's go to step 6 because there are options that you can apply to the musts that may lower their actual cost. |

|

|

Step 6: Assess your options |

|

|

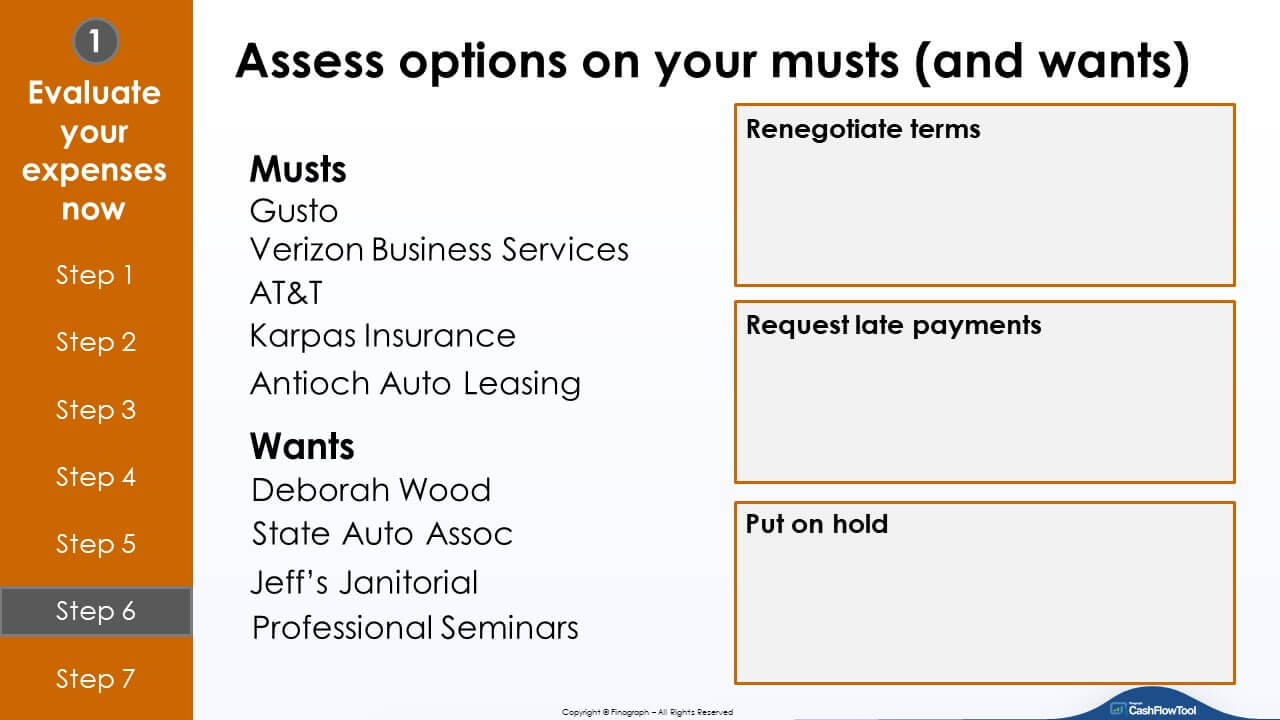

We now take our musts and wants and build options for each. Here you see we have created 3 options: Renegotiate Terms: Here you can go to the vendor and negotiate a lower price (lower your cell bill, internet bill, % pay cut for employees, etc Request late payments: You can discuss with the vendor if you can simply make your payment 60-120 days late but still keep using the expense. Many vendors are doing this to keep your business. Put on hold: Either pause the expense for awhile or cut it altogether. You now have your "action" list to go work with your vendors to see what you can do and once you have it completed for each, go into CashFlowTool and adjust the numbers in the forecast to see the impact to your cash flow. |

|

|

|

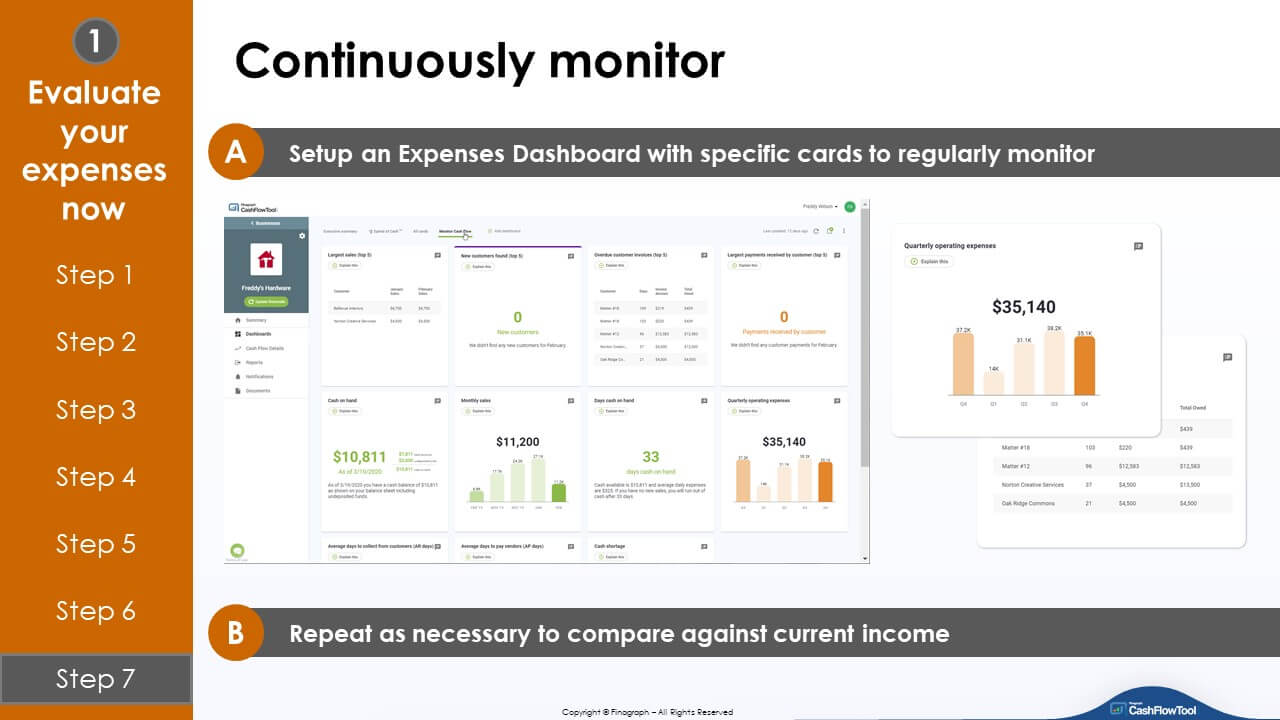

| Step 7: Continuously monitor | |

|

The last step is to use CashFlowTool to continuously monitor your expenses. Create a new dashboard (name it "monitor expenses" and consider adding the following cards: - Unexpected Bills You now have a quick way to see the impact of your expenses. Lastly, you will probably need to repeat this process as necessary to compare again current (and projected) income so that you remain cash positive. |

|

Other Resources:

Blog: How to review your future income

Blog: Stress Test your P&L

Blog: Calculate & Forecast your cash burn rate

Blog: Perform cash break-even analysis

Our Covid-19 "Help my Business" Resource Center

Have questions? Email the CashFlowTool team