In the uncertain times that have come with the Covid-19 crisis, understanding cash burn rate could be the difference between your business' survival and salary cuts, layoffs or business closure. Cash has always been king, but that statement is even more true today.

In this article and the video below, we will define cash burn rate, teach you how to calculate it and how to use (or interpret) the results for your business.

|

|

|

|

What is a "Cash Burn Rate"? |

|

|

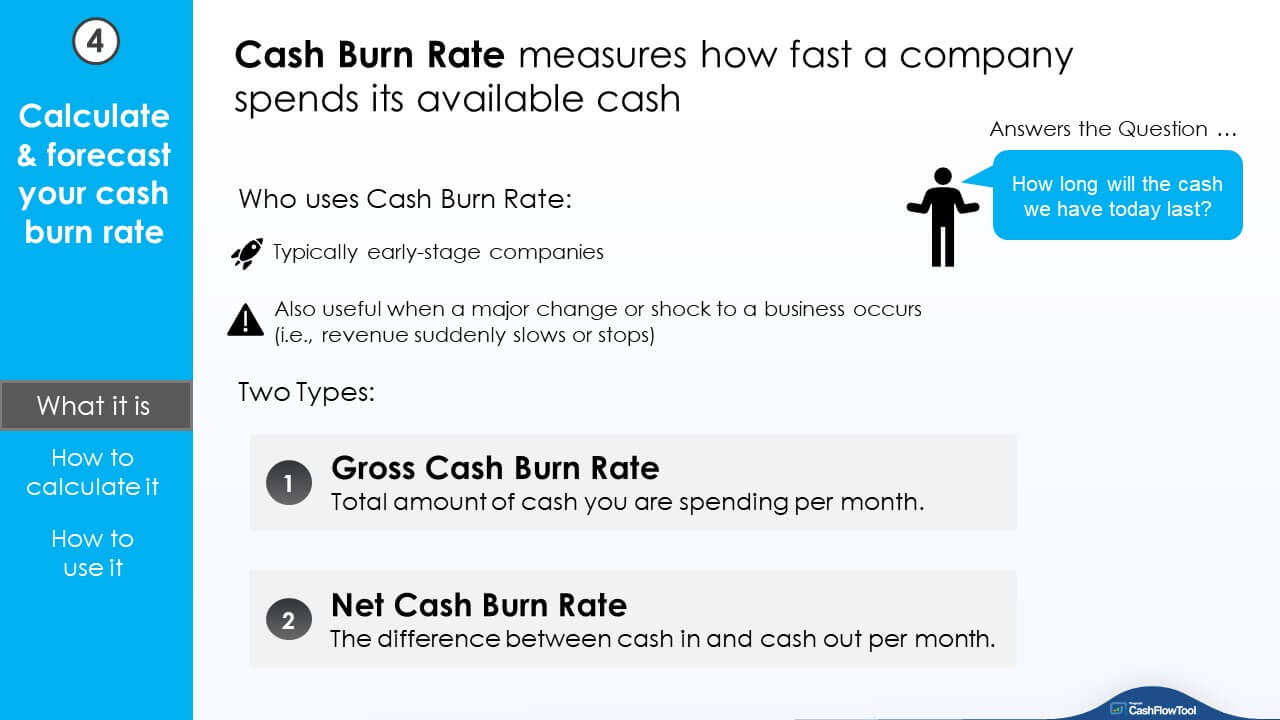

A simple definition of cash burn rate is how fast a company spends its available cash. It also answers an important question: "How long will the cash we have today last?" Burn rates are commonly used by early-stage companies so owners and investors know how long the cash they put into the company will last if the company continues at current levels of revenue and expenses. Burn rate is also very useful when there is a major change or a shock to a business (for example, revenue suddenly slows or stops). In this case, we use cash burn rate after evaluating our expenses and reviewing our income to see how long the cash we have today will last. This helps you understand what your runway is and also can help you determine how much and if a loan would help. There are two specific types of cash burn rate:

|

|

| How to calculate your cash burn rate | |

|

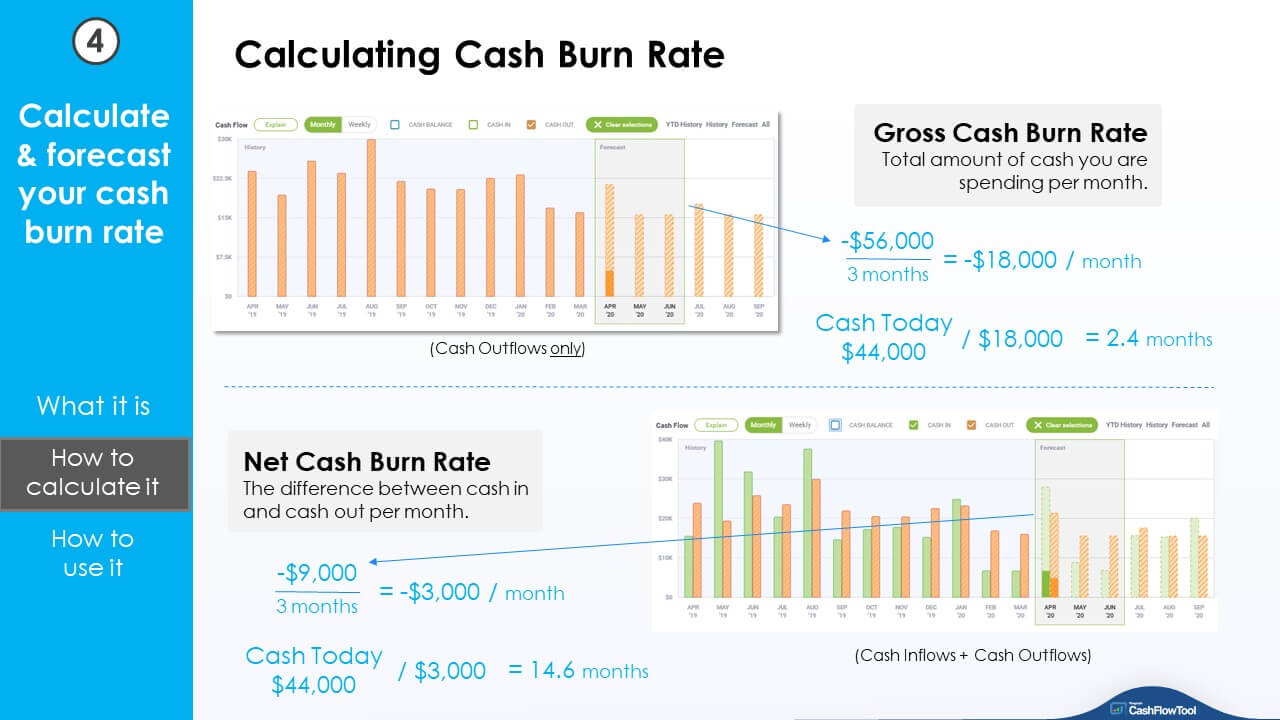

Cash burn rate can be measured monthly, weekly or daily and for any period of time. You may want to calculate cash burn rate using your past 3 months (actual) activity. In this case, we are able to make a statement like this: If we continue spending at the same level as we did over the last 3 months, the cash we have today will last ____ days/months. You can also calculate cash burn rate moving forward after producing a cash flow forecast in Excel or using software like CashFlowTool. In this case, we are able to make a statement like this: Based on our expected expenses for the next three months, if we continue spending at rate, the cash we have today will last ____ days/months. Here's how you calculate each type. To calculate your gross cash burn rate, simply add the total cash outflows for a specific period (for example, 3 months) and divide it by the numbers of periods. Next, to determine how long your current cash will last using this burn rate, divide your current cash balance by the gross cash burn rate you calculated above. To calculate your net cash burn rate, simply add the total cash inflows and outflows for a specific period (for example, 3 months) and divide it by the number of periods. Next, to determine how long your current cash will last using this burn rate, divide your current cash balance by the net cash burn rate you calculated above. |

|

|

|

| How to use it | |

|

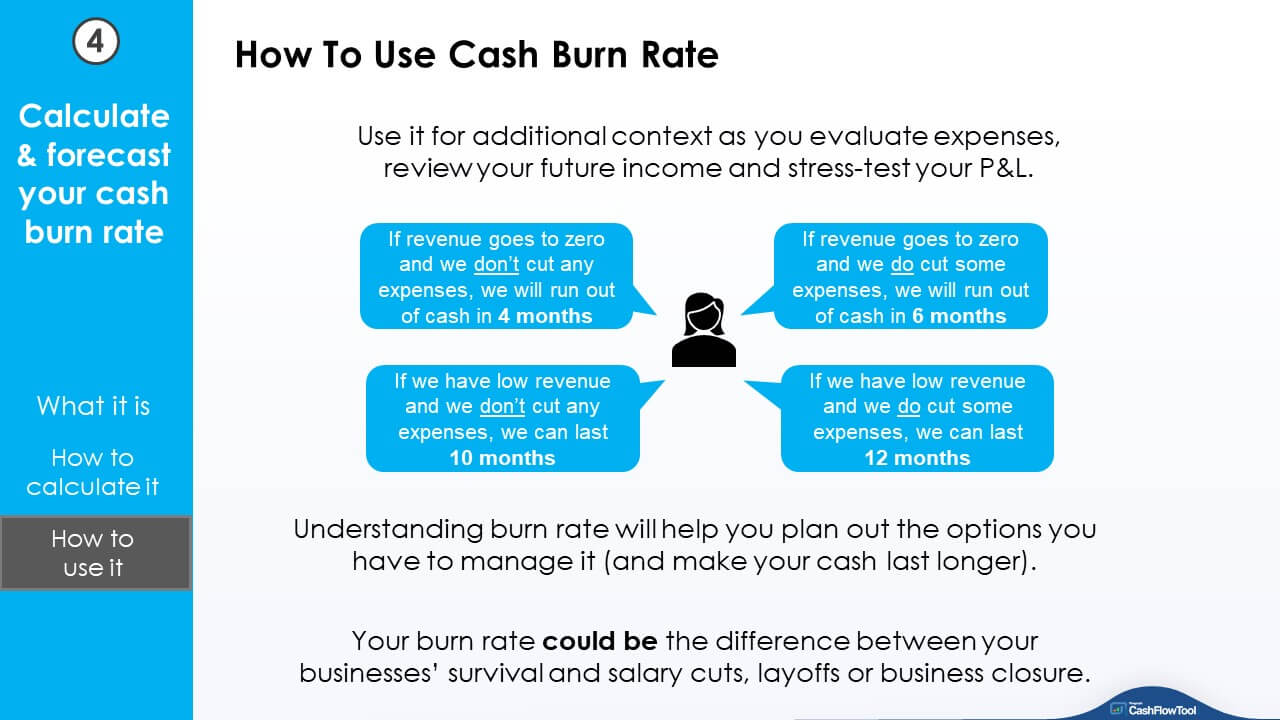

Once you have the amounts calculated, you can use the information to help you plan out the options you have to manage it (and make your cash last longer). For example, if you find out that your gross cash burn rate is $10,000 per month, and you have $28,000 in the bank, then you will run out of cash in a little less than 3 months if you have no revenue coming in. Use this for context as you work through your available options (draw on your line of credit, apply for an SBA loan, cut certain expenses, etc.). If you cut $2,000 in monthly expenses, your cash will last about 3.5 months. If you are approved for an SBA loan of $50,000 (assuming you receive the funds before the end of 3 months from now!), then your cash will last nearly 8 months. When you are managing and forecasting cash during the COVID-19 crisis or any other shock to your business, the more information, the better. Having a software tool to easily be able to pull in relevant data, perform calculations and what-if analyses will also greatly benefit you during these times. Check out the video at the start of this blog to learn how to perform all of the above in CashFlowTool. |

|

Other Resources:

Blog: Evaluate your expenses NOW

Blog: Review your future income

Blog: Stress Test your P&L

Blog: Perform cash break-even analysis

Our Covid-19 "Help my Business" Resource Center

Have questions? Email the CashFlowTool team