Break-even analysis has long been used in the context of companies identifying how to become profitable or determining pricing strategies for new products and services.

In this article and the video below, we will outline how you can use a cash break-even Analysis to help identify the amount of revenue you need to cover your expenses.

We'll start with defining cash break-even, then teach you how to calculate and use (or interpret) the results for your business.

|

|

|

|

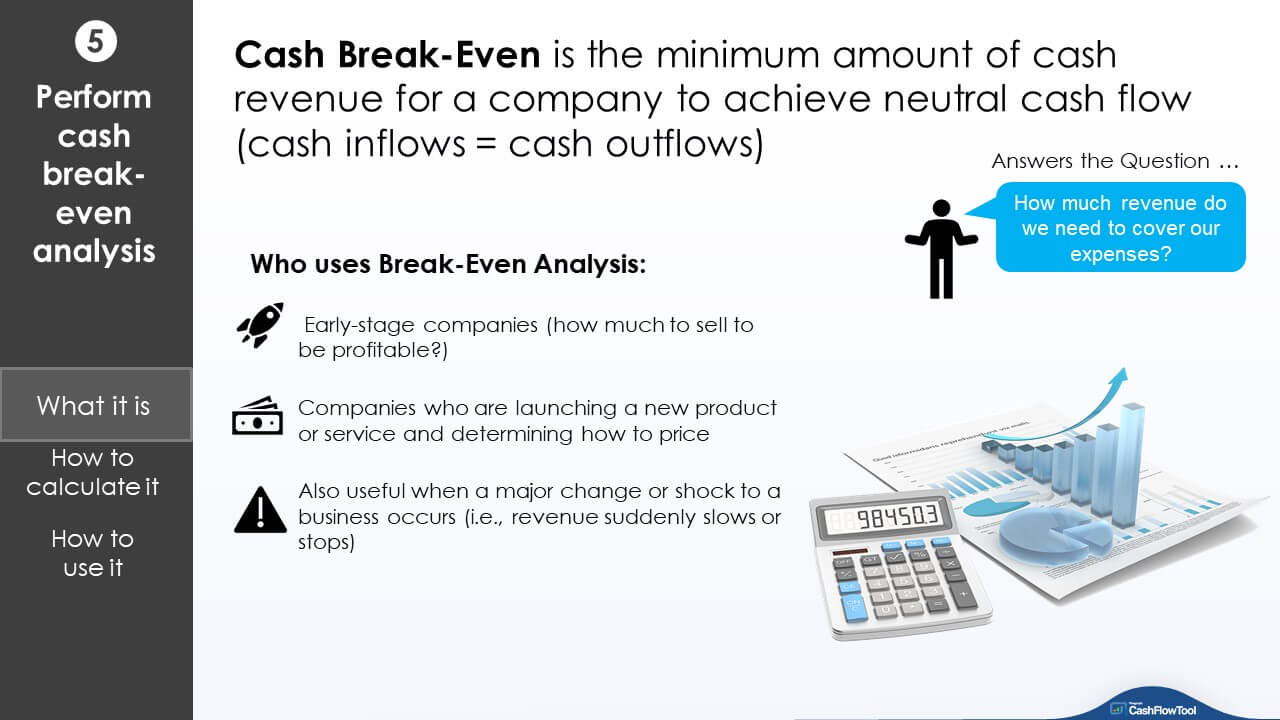

What is "Cash Break-Even"? |

|

|

Cash break-even is defined as the minimum amount of cash revenue a company needs to achieve neutral cash flow (cash inflows = cash outflows). A cash break-even analysis helps you solve for that amount of cash so you know what to target in your own business. Using a cash break-even analysis is very useful when a major change or shock to a business occurs (for example, revenue suddenly stops or slows). Performing this analysis will help us answer the question: "How much revenue do we need to cover our expenses?" Let's move on to talk about the calculation. |

|

| How to calculate cash break-even | |

|

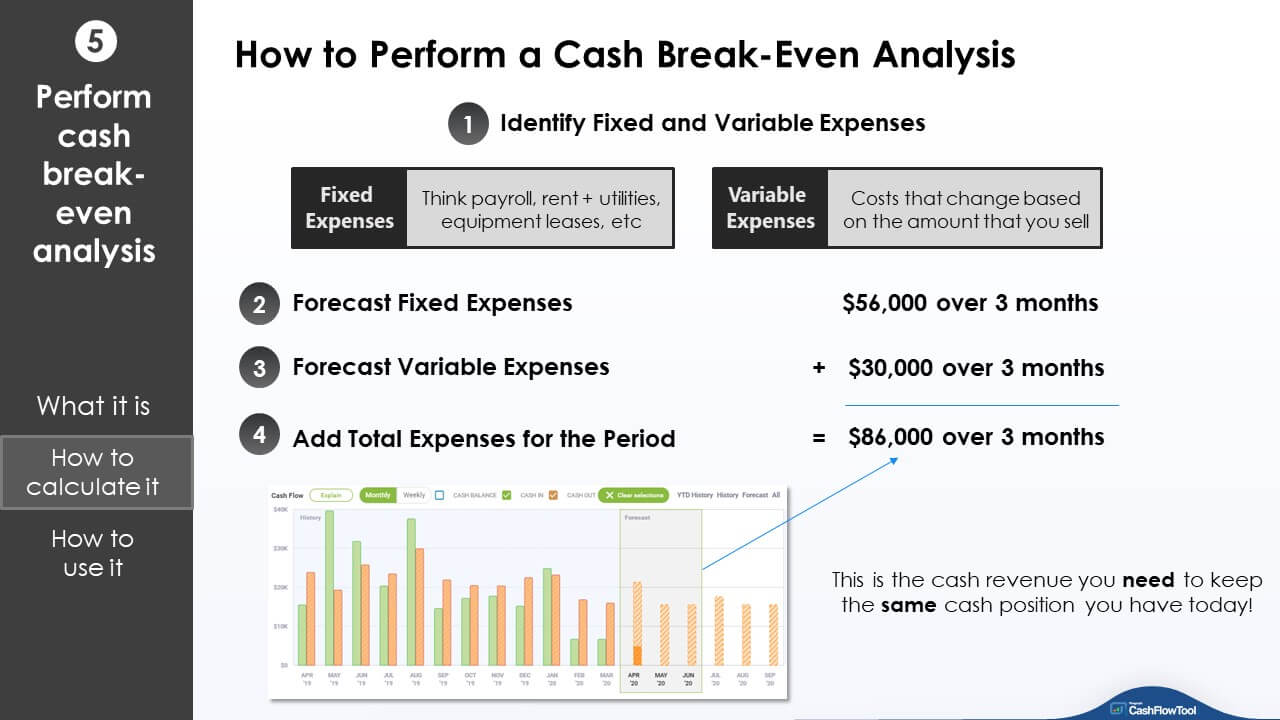

When you calculate your cash break-even, we are working with forecasted expenses (i.e., those that you are planning for and expect to occur in the future) and you calculate it over a period of time. To do this most accurately, it requires some pre-work, such as evaluating your expenses. When evaluating the expenses for your business, identify costs that are fixed vs. variable. These are important, because you will use different forecast methods for each. Let's define each:

Let's go through a simple example calculation for the next 3 months. This will help us determine: How much revenue is required to cover our expenses for the next 3 months, so we keep our cash balance consistent with what it is today? Start with fixed expenses. Our salaries, leases, and rent amount to $18,700 per month, or $56,000 for the next 3 months. Now for variable. Keeping things simple, we estimate that variable expenses required to sell at least $56,000 of product (to cover our fixed expenses) in 3 months is $30,000.1 If we add up the fixed and variable expenses for the 3 months, we have $86,000 in total expenses. This is the amount we need to sell to keep a neutral cash position and cover all of our expenses for that period. This is our cash break-even point for those 3 months.

1 Variable costs vary tremendously company-by-company and industry-by-industry. Your costs could be as simple as a fixed margin for items that you sell (if you are a reseller) to highly complex calculations involving labor, fluctuating material costs, 3rd party contractors, etc. For the purposes of calculating a cash break-even, make sure to keep in mind that we are focused on cash costs to reach a certain level of revenue in the short-term. The above is a simple illustration of the calculation of cash break-even only, not a demonstration on how to calculate variable cost. |

|

|

|

| How to use a cash break-even analysis | |

|

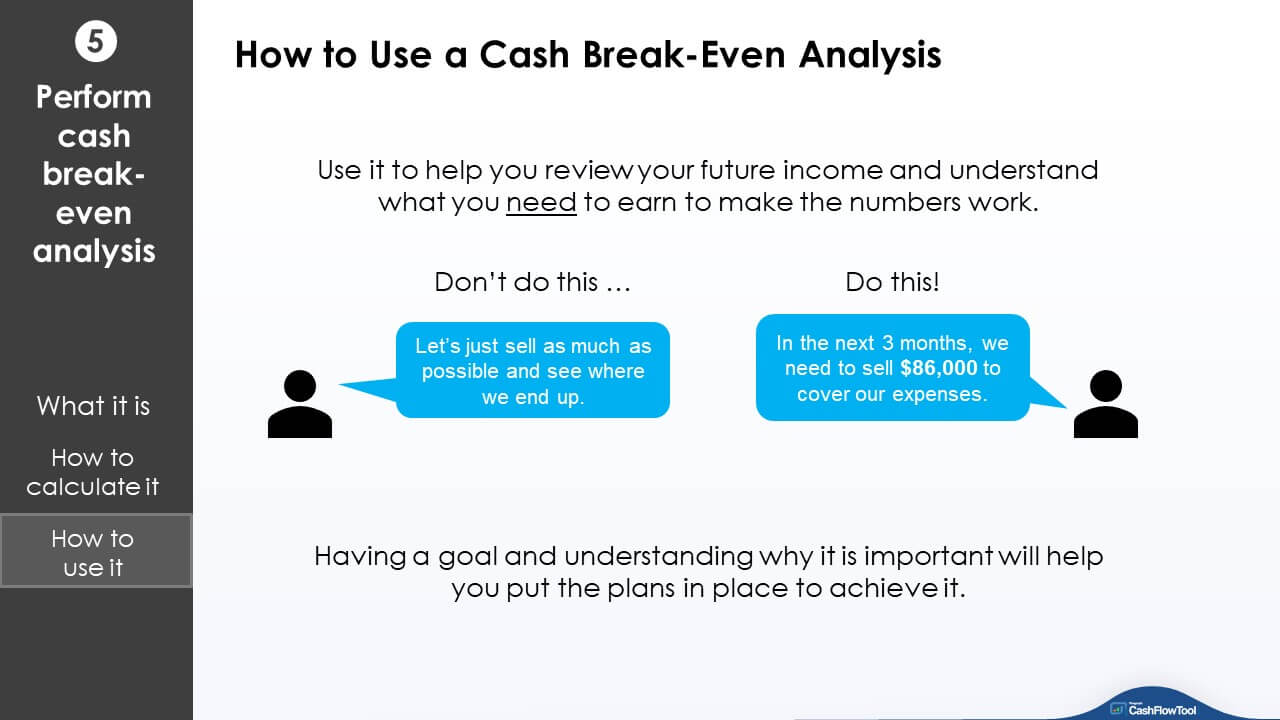

A cash break-even analysis will identify a target for revenue for a period of time. Why is this important? Because it will help guide you in creating a plan of attack to achieve it. Most importantly, it will help you evaluate options and determine where you should focus your time. It's easy to say... "Let's just sell as much as we can. Having a target won't change the fact that we are going to try and generate a lot of revenue." But keep in mind, not every opportunity and every task that you could do is worth the same amount for your business. Going through a cash break-even analysis will allow you to make a definitive statement like: "In the next 3 months, we need to sell $86,000 to cover our expenses." With that target in mind -- you can review your future income and put a plan in place. |

|

Other Resources:

Blog: Evaluate your expenses NOW

Blog: Review your future income

Blog: Stress Test your P&L

Blog: Calculate and Forecast your cash burn rate

Our Covid-19 "Help my Business" Resource Center

Have questions? Email the CashFlowTool team