We’ve all watched entrepreneurs go onto Shark Tank and pitch their product to the Sharks. Some participants are so impressive the way they deliver a clever pitch that instantly grabs everyone’s attention, while other participants fail miserably and makes you cringe inside.

While my son and I have watched many episodes together, one business in particular stuck out to me. Two cousins from Maine pitched the idea of a food truck selling lobster. After seeing an update on the business this year, I decided to learn a bit more and picked up their book Cousins Maine Lobster: How One Food Truck Became a Multi-million-Dollar Business. The book provided a detailed account of how they started their business, landed on Shark Tank, and how their deal with Barbara turned their food truck into a multi-million dollar business.

The book was a fun read and provided some great insights into starting a business and all of the work that is involved. However, one of my favorite chapters was titled "Oh, Right, Money Matters" because it highlights the value and critical importance of understanding the key metrics of any business.

In this chapter, the book mentions a conversation between the co-founder, Jim, and his father, Steve.

Over dinner, Steve, being very business savvy and having a good understanding of accounting, asked the founders a few casual questions about their business. “So, what are your operating expenses?” After a blank stare, he asked: “When was the last time you completed a P&L?” Again, more stares. The co-founders Jim and Sabin didn’t even know what P&L stood for.

Steve knew his son was in trouble and could use some financial advice. Here's the best part: Steve offered to help his son but wasn’t willing to help for free. Steve knew his son needed help but also knew the services he provided were worth paying for. Cousin Maine Lobster is another example of what we already know, but often forget:

Small businesses are so focused on running their business, they don’t realize they are going broke.

This is what Jim says happened to him.

“One of the first things we learned as entrepreneurs are that sales don’t equal success. It’s a hard idea to wrap your head around. You mean product could be flying off the shelves – our truck’s window – and yet things are going badly? That doesn’t make sense. But sales can be an illusion, a very dangerous illusion. If you don’t know any better, sales can make you lazy.

Sales give you a false sense of progress. Like us, you might believe that money in the cash register at the end of the day is yours. It isn’t. Most of it belongs to someone else; you are just the middleman. The only dollars that are yours are those left over after everyone else has been paid. It’s usually a very small amount. Even then, those leftovers might not be yours for very long. You might need to pump that money – the lifeblood --- back into the company’s body to buy new equipment, to hire another employee, to add another product. Point is, just because your company is making money, doesn’t mean you are.”

Jim provides some great insights into some of the challenge’s small businesses face.

- Owners are focused on running their business, not keeping track of their finances.

- Many have a false sense of security when sales are growing.

- Owners don’t know what they don’t know and need the help of a trusted advisor.

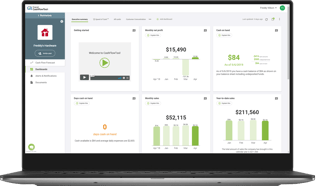

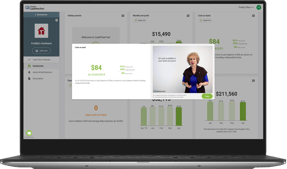

Reading the book Cousin Maine Lobster provided me another great reminder why we built CashFlowTool, to help every small business succeed and avoid financial failure. CashFlowTool was designed from the ground up to be used by small business owners and their accountants. Here are a few key examples how.

|

|

|

.jpg?width=351&name=collaboration%20with%20team%20members%20(June2019).jpg) |

|

| Built-in Coaching | Complete Metrics | Seamless Collaboration | ||

| Every dashboard card includes a built-in video coach which makes it easy for every business owner to understand what metrics are being shown and how they can use the metric to improve their business. | CashFlowTool provides a complete picture of the health of the business via the dashboard KPIs and also shows your historical performance and a 6 months future forecast. | CashFlowTool makes it easy to keep everyone informed and up to date. Invite the entire team to view the cash flow forecast, dashboard, and financial statements. |

Fortunately, Jim’s dad was able to provide him the advice he needed early on, but many businesses are not as fortunate. Knowing this about small businesses provides you an opportunity to be like Jim’s father and provide business owners the financial coach they need. By leveraging CashFlowTool, you can provide the financial services small businesses need. Who knows, maybe sometime soon my son and I will be seeing your client’s business featured Shark Tank!