Let’s talk about cash flow. More specifically, why we need to change the conversation around cash flow. Current cash flow conversations focus on trying to survive (crisis aversion) instead of planning to thrive and managing that state when we and our clients get there (command and control).

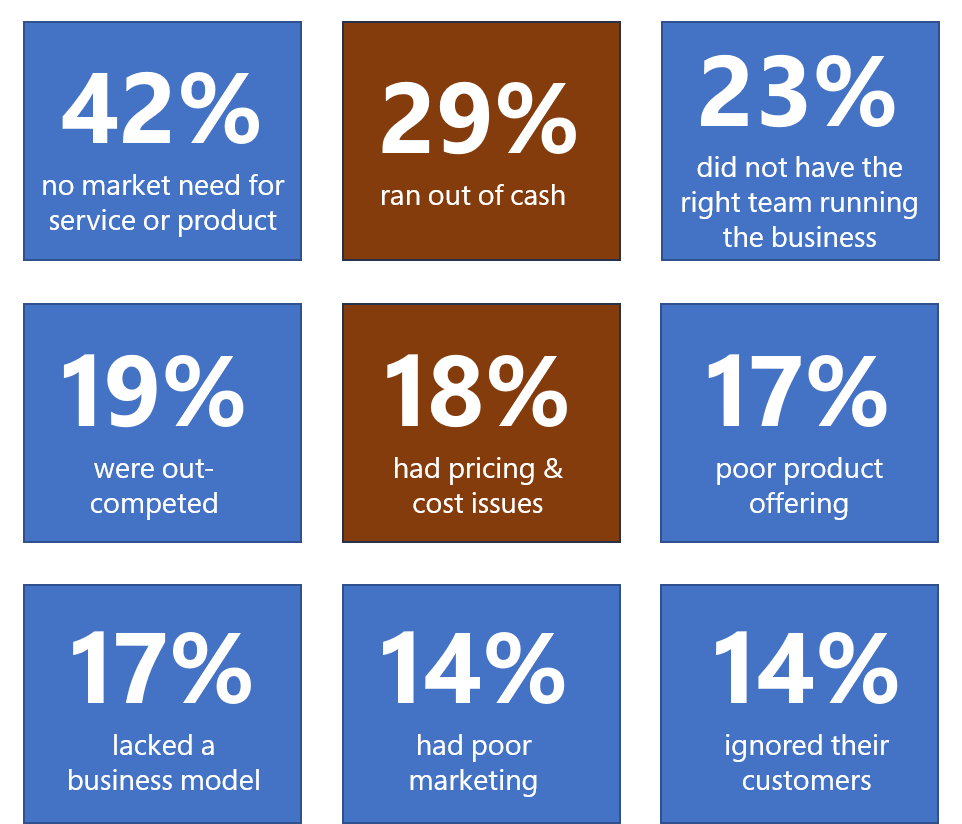

We can quote business failure statistics with ease: 20% fail in the first year, 50% by the fifth year and 70% by the tenth year. Are you clear about why they fail? According to CBInsights analysis here are the top reasons for failure:

If you notice, there are at least two of those business failure reasons that you are easily positioned to tackle – running out of cash flow and pricing/cost issues.

![]() What if we changed the conversation from just surviving and stressing to planning and thriving? Making cash flow not just something we pay attention to when the bank balances are low, but as a regular business/financial management practice.

What if we changed the conversation from just surviving and stressing to planning and thriving? Making cash flow not just something we pay attention to when the bank balances are low, but as a regular business/financial management practice.

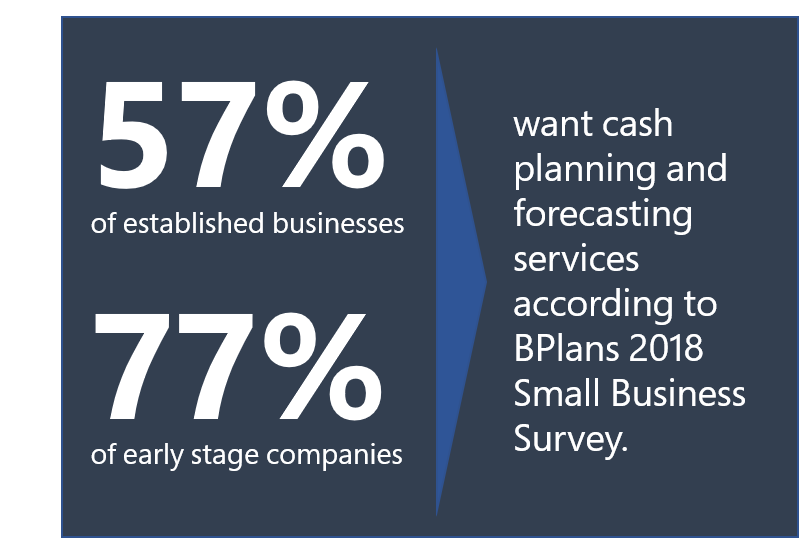

Need a little more evidence that your current and prospective clients would be open to this conversation?

Happy to oblige.

Suntrust published a survey of 2018 trends for small business owners. Here are some of the highlights:

Top financial goals for 2018

59% grow their business and its revenue

55% increase business profitability

27% control and manage cash flow

Top 4 uses of extra money from tax reform

35% employee bonuses, raises

33% company expansion or growth

30% pay down company debt

29% build cash reserves

One more survey – C2FO’s working capital outlook survey (2017).

Here is what business owners in the survey say they would do with additional cash:

33% purchase more inventory or equipment

28% expand operations such as exporting to new markets or opening new locations

16% use it to meet current obligations

10% invest in employees through hiring, wages and benefits

9% invest in R&D

4% create contingency plans to deal with unexpected events

From this data, I would bet that you could see yourself having a different or more frequent conversations with your clients about cash flow.

Still not convinced? Here is why we think it is important to change the conversation you have with clients around cash flow.

Changing the conversation around cash flow puts you in the position of success partner with your clients. How? Glad you asked.

- You can help them move away from using their mobile banking app to “manage” cash flow to relying more on the cash balances in QuickBooks as the true “current reality”.

- You can show them what is possible with the expected cash inflows and outflows from current operations, at the minimum for 90 days ahead.

- With this information and your recommendations, they are able to get a better view into their cash flow patterns. Then they make better business decisions for now and the long term.

When your clients experience fewer surprises in their cash flow because you communicate regularly about what’s happening in the finance area of their business, they will trust you more. The more they trust you, the more they will come to you first about the issues that keep them up at night. Beyond accounting, beyond bookkeeping and beyond taxes.

Changing the conversation around cash flow from crisis aversion to command and control highlights your expertise and positions you from just a “bean counter” to the business partner your clients can count on.

Want to learn how CashFlowTool can help you change the conversation around cash flow?

Schedule your strategic consultation today.