Every business knows that cash is king, yet an alarming number of businesses (only 33%) don’t even use a tech platform, tool or app to manage their cash flow1. Here are 7 practical tips that every business owner should use to help with their cash flow.

For those that do use a tech platform, tool or app, it is probably a manual process done in Microsoft Excel which is a great tool but takes a considerable amount of work to get an effective cash flow forecast. Furthermore, 74% of businesses judge cash flow tasks as difficult according to a 2019 study2.

This is precisely what we made CashFlowTool. We designed it to be simple to connect to your QuickBooks Online or QuickBooks Desktop and within minutes, get a 6-month future forecast that as a business owner, you instantly see KPIs and future forecast that you simply don’t get in QuickBooks.

As a former small business owner, having mature and simple tools to unlock insights on my cash flow is exactly what is needed to run and operate my business successfully.

Here are 7 important cash flow tips that you should consider when running your business and of course, CashFlowTool will make it dramatically easier to manage and forecast your cash flow.

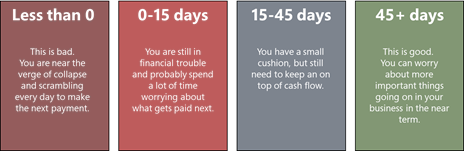

1. Ensure your days cash on hand is 45 days or better

Most business owners look at their current cash balance (cash on hand) in their check book and make quick decisions whether they can afford something or not. The reality is that there may be expenses coming in that will claim the cash balance at some point in the future, so you must know what the days cash on hand really are. CashFlowTool has 2 great dashboard KPIs that you can keep your eye on:

|

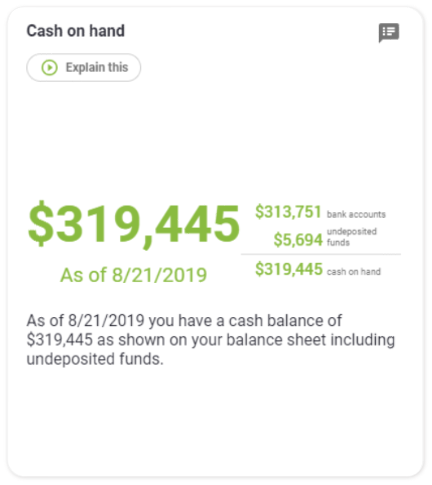

Cash on hand. This shows you the sum of all the cash in your bank accounts plus any deposited funds that you have.

In this example, it looks like the amount is very strong, yet the business owner must look at all the other factors that will use the cash and once done, can judge if this is really good or not. |

|

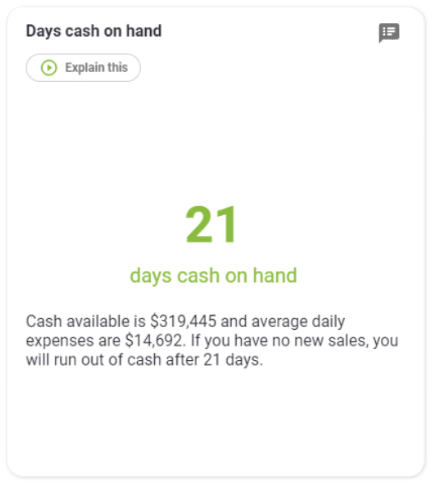

Days cash on hand. This shows the number of days that cash is available factoring in expenses and assuming no new sales. Below is a chart that gives you guidance of where you should be.

|

2. Understand what your payment terms are

You might have some great contracts with your customers and yet many larger customers have longer payment terms (Net 120, Net 60, etc).

There was a time when I landed a large contact with a large company that required me to ramp up people and resources. I was super excited, and we were making strong progress on the new contact. As things ramped up, so did the expenses and the fact that I had to pay the people that were doing the work. The problem however, was the large company had a Net 60 which meant the first check would not come in for 2 months and yet I had to pay the expenses and payroll out of my own pocket which put me in a significant cash crunch. Consider negotiating the payment terms up front to ensure adequate cash flow.

The Average days to collect from customers KPI in the dashboard is a great overall summary of how all of your customers combined on average pay you in number of days. Generally, this should be as low as possible.

3. Keep an eye on your expenses

If you are not careful, expenses add up quickly. Some new expenses seem harmless to add to your overall bills like a license to Zoom or new software as an example. Furthermore, most expenses these days are put on a company charge card with an annual billing that is done initially and not remembered until the following year. And the larger your company gets, the more expenses come in with possible duplication – maybe one employee thought it was great to use Zoom, while another got a license for another conferencing tool.

It’s important to keep an eye on your expenses doing an annual audit to ensure you need all your expenses and decide if you should cut some. This is one of the strongest ways that you can increase your cash flow. CashFlowTool makes it easy to see your monthly expenses and trend:

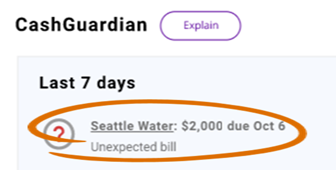

But what do you do when you have an unexpected or higher than normal bill that you didn’t even know about. An example might be a water bill where every month it is roughly the same and auto paid through your business checking account or credit card. You don’t see a bill come in and maybe it was dramatically higher due to a leak or higher than normal usage. How would you really know? CashFlowTool’s built-in CashGuardian™ service will watch over your business expenses and alert you to anything out of the norm so you can take action.

4. Increase Sales

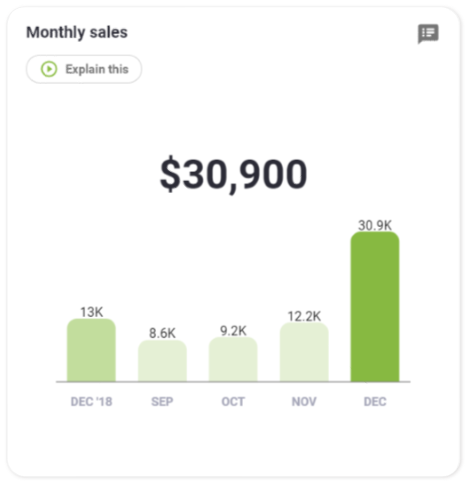

This is an obvious, yet important one. You can set goals for your sales team and then use CashFlowTool to know how your monthly sales is doing and also how it is trending over the past few months. You can analyze the sales along with the expenses and you start to see a better trend on how your cash flow is really doing. Learn more by reading our blog article on team alignment to learn ways to do this in CashFlowTool.

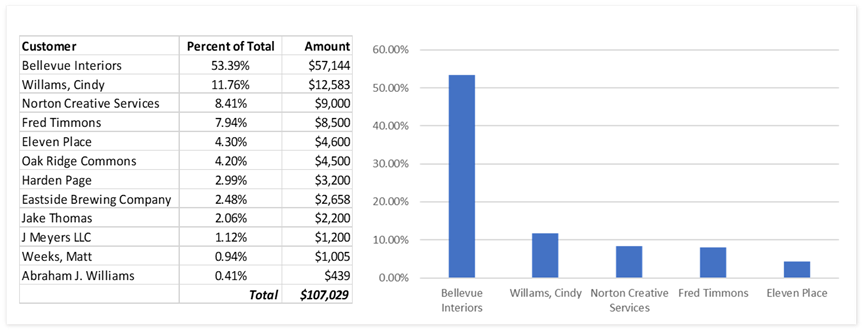

5. Know your Customer Concentration

Many small businesses rely on sales from just a handful of customers and in some cases rely on sales from just one or two customers. Don’t be too dependent on just one or two customers because losing one could potentially really hurt your business. Focus on getting more customers to broaden your revenue stream.

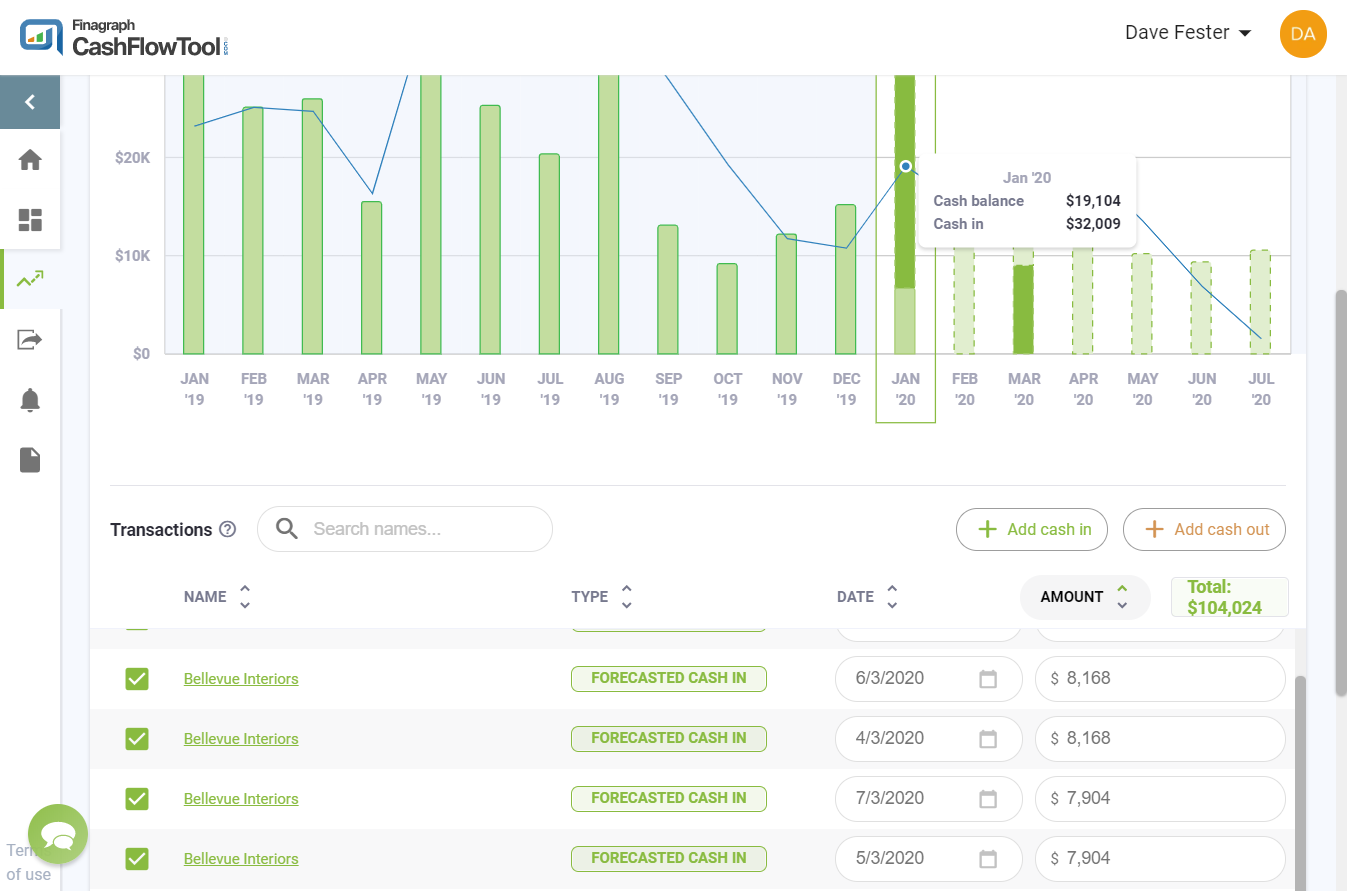

You can see your top customers very easily in CashFlowTool today and projected out 6-months in the future. Simply go into Cash Flow Details, uncheck Cash Out in the chart, and click on the amount label in the transactions listing below the chart until it sorts to highest amount on top.

Learn more

Customer concentration is where you calculate the revenue coming in as a percentage of your total revenue and understanding the dependence your business has on your customers. You can see this in Excel when you export your forecast and total all of your customers revenue and simply calculate each customer as percent of total.

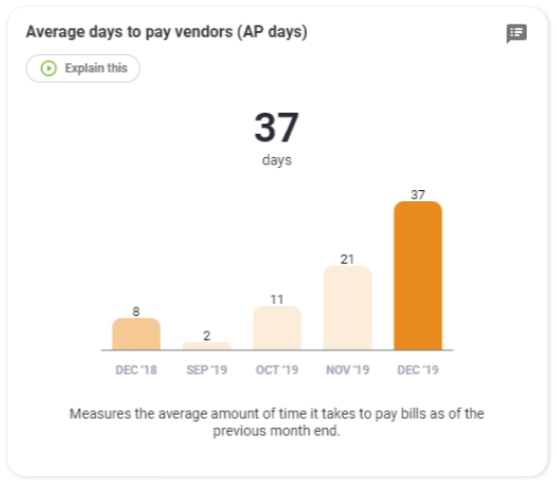

6. Know how fast you pay your vendors

Just like you want your customers to pay you in a timely manner, your vendors want their payments quickly as well. You may be paying your vendors too early which can hurt your cash flow. You can delay payment as logo as possible while meeting the terms of your vendor contact. CashFlowTool can show you the average days to pay your vendors and you should consider stretching this out as long as possible without being late on your payments. You always want to have a good relationship with your vendors and avoid late payments as it can hurt the relationship and potentially impact your good credit rating.

7. Know your cash flow forecast

Knowing your future cash flow forecast gives your business your cash road map. You get a much clearer idea of where your business is headed versus using just your cash on hand as a means to make decisions.

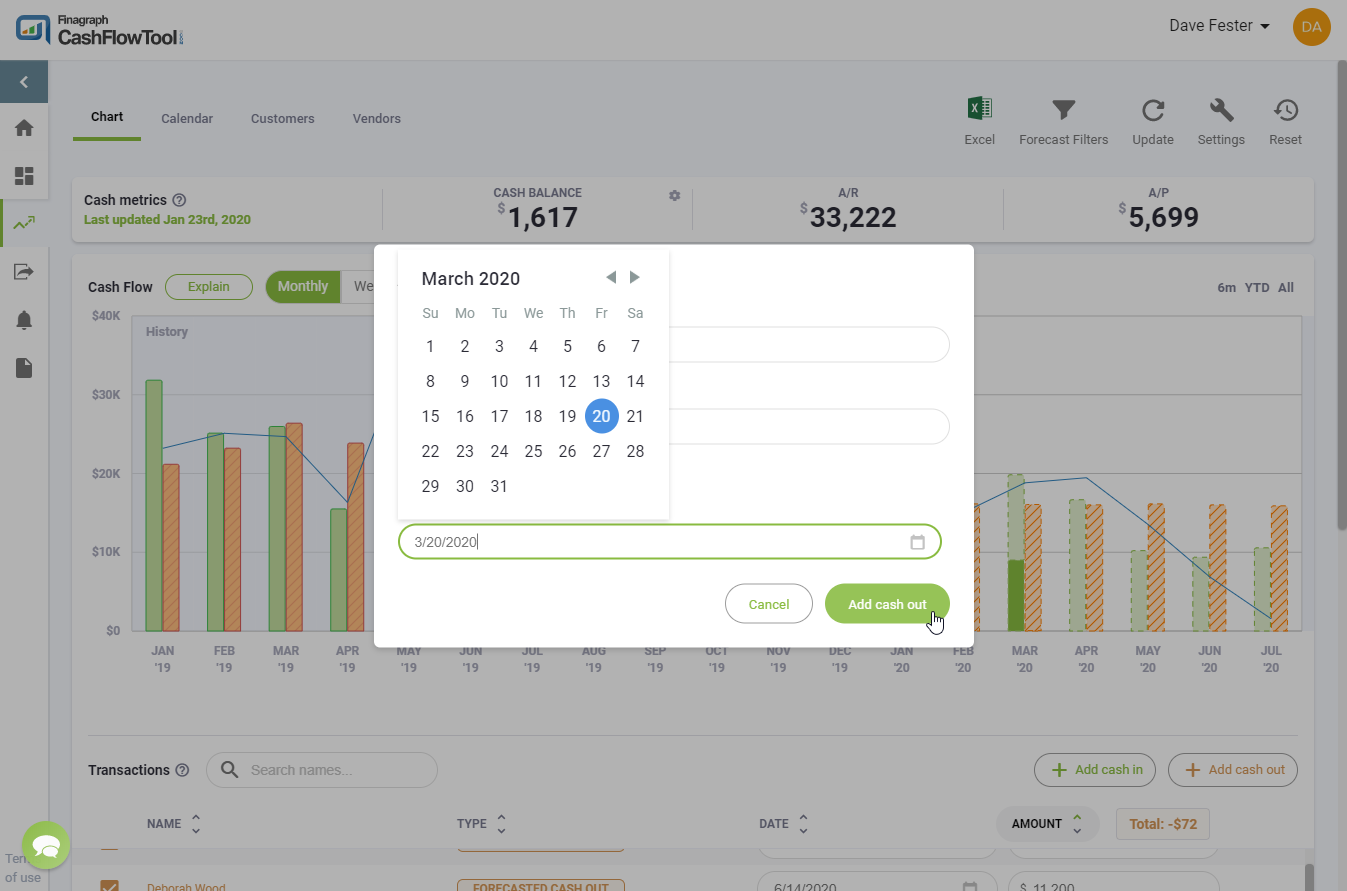

CashFlowTool makes it simple to know your future as it looks at your historical QuickBooks data 15 months in the past to see the patterns and projects a 6-month future forecast. The Interactive Chart makes it simple to see how you are doing each month and gives you an opportunity to do a few what-if scenarios. For example, you need to buy your employees new laptops and you are not sure what month is the best month to do it. CashFlowTool lets you easily add a manual Cash-Out transaction and immediately see the impact on your future 6-month cash flow. If you put the laptop expense on a specific day in a future month and you realize that might not be the best month due to other expenses, you can quickly change the date of the laptop expense and see if that will work for your company. Read more on how to use CashFlowTool's What-if Scenarios.

I recommend that you review your cash flow forecast weekly to get the insights you need to run your business effectively and use these tips so you know what levers affect your cash flow.

1 & 2 - Ipsos Public Affairs – Bank of America Small Business Owner Survey, Spring 2019

Have questions? Email the CashFlowTool team