In the past, most accounting, bookkeeping or advisory firms used to rely on getting customers from their local city and would conduct regular meetings (quarterly tax, annual tax, business health assessments, etc.), at their physical office. If you are considering extending your practice to a virtual one, this is a must read for you...

This required the client to take time to travel to the accountant’s office which limited the accountant’s clientele to those who lived a relatively short distant from their office. It also required the client to take with them all the necessary documents needed for the meeting, or risk having to run back and grab left-behind documents. On top of all this, what might be just an hour of actual meeting time for the client, might in fact be much more due to lost time commuting and gathering documents.

With the modern office, advances in technology as well as advances in software as a service (i.e. cloud-based solutions), you might want to ask yourself whether this is finally the time that you expand existing practice to also be a virtual one. Here are some quick advantages:

- Expand your client base to virtually any one you want. Location is no longer an limitations because your meeting place will take place on-line. You can extend your practice nationwide if you want!

- Makes it easy and convenient for your clients. With one click-access, they can join your meeting from anywhere in the world whether the client is at home, at their business, or traveling. It’s convenient for you and convenient for your clients.

- You can share documents virtually. With services like OneDrive or DropBox you don’t always have to do printouts that are out of date soon after printing.

Here is a software & hardware check list of some of my favorite online tools to help with your virtual practice:

1. Zoom Video Conferencing: Zoom is rapidly become one of the must-have software tools and it’s no surprise because it is not only great, it is really great. Zoom offers a free version that lets you conduct online meetings that are limited to 40 minutes. This probably won’t be enough for most accountants or bookkeepers and so I recommend you purchase the Pro version which gives you longer online meeting times, a custom personal ID that is predictable for every client, and the ability to control when someone enters the online meeting.

You can also easily share screens and documents making the virtual meeting very productive. There are other solutions out there like Skype, GoToMeeting and others, but Zoom is heads above the rest.

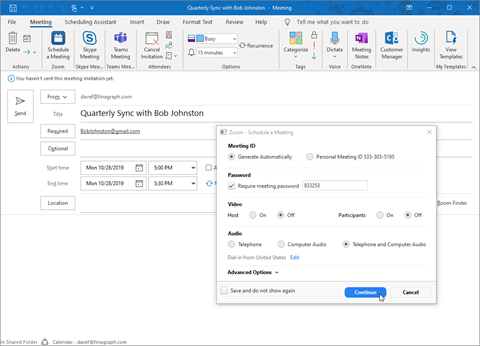

2. Integrated Zoom Meeting Scheduling with Outlook: Zoom offers a plug-in to Outlook which lets you seamlessly schedule Zoom virtual meetings directly in Outlook just like you would schedule any other meeting. Outlook works with all major email systems including Gmail so you should consider giving it a try.

3. Logitech C922x Pro Stream Webcam – Full 1080p HD Camera: This is a fabulous $80 USB high-def camera that you can use with your clients. Your clients want to see you and this gives a full HD picture along with a great microphone. When you use this, it is about as good as having the meeting in person.

Pro tip: When a new client joins your practice, send them a welcome kit which includes the Logitech camera. Your new clients will appreciate the gift and will ensure both you and your client have the hardware needed for a successful meeting.

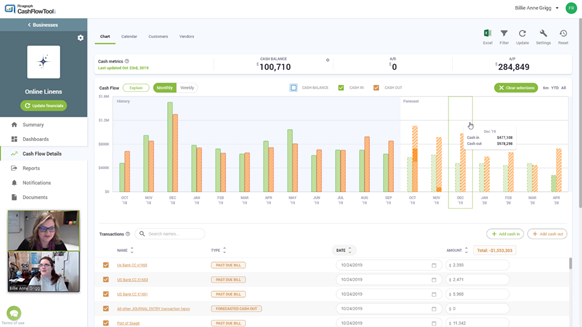

4. CashFlowTool Cash Flow Forecasting Service: CashFlowTool is a service that operates in the cloud making it simple to access from anywhere. While in a virtual meeting, you can share the business cash flow forecast with your client and instantly collaborate on all aspects of their cash flow situation.

Depending on the way that you have implemented CashFlowTool for your clients, you can choose to let them see it the following ways:

Level 1: Export Excel

|

Simply export the CashFlowTool forecast data to Excel and share the spreadsheet with your client. You can also share the PDF cash flow summary report too. They will see the cash flow forecast in an easy-to-understand way, but you control when they receive the report and you can walk them through it. Learn more about CashFlowTool Reporting

|

Level 2: Share Screens

|

You can share certain screens of CashFlowTool to show the client their key cash flow metrics and forecasts. |

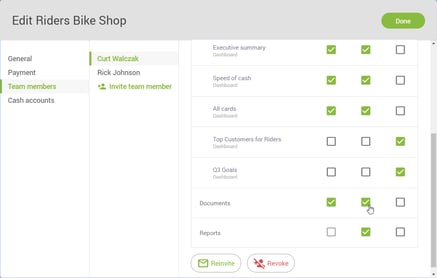

Level 3: Accountant has full control, clients have read-only access

|

You are the main owner of the CashFlowTool account and are the one that syncs with business’ QuickBooks. You grant the client access to CashFlowTool, but give them read-only permissions to each area (forecast, dashboards, calendar, docs, etc.). |

Level 4: Accountant and Clients both have full control

|

You and your client have joint control and access to CashFlowTool. You can train your client how to read, understand and use the information. Your client can explore, make updates, run what-if analyses, etc. You then provide oversight and advice to them based on the tool output. |

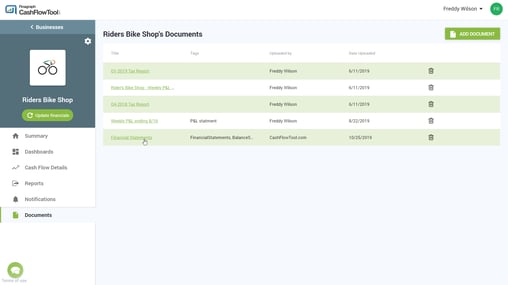

5. Securely sharing important documents: CashFlowTool offers secure document storage making it easy for you and your clients to have one unified place to share documents. While it is not as richly featured as DropBox, GoogleDrive or OneDrive, it comes with CashFlowTool and you can control who has access or not.

|

|

Pro Tips to ensure the virtual meeting runs great:

- You should plan in advance to ensure online meetings runs smoothly. Practice the meeting ahead of time with a friend or colleague to learn how to use Zoom with confidence.

- Ensure you have fast enough Internet to conduct a virtual meeting. For High-Def video both ways, Zoom recommends at least 2.8 Mbps up/down. You can also check their other requirements here.

- Prepare your office where you will conduct the virtual meeting to be fully ready: Ensure your office is clean & neat and try to keep background noises to a minimum. While this is probably one of the best videos around of a video meeting interruption, you might not want this when in a deep conversation with your clients.

- Consider having a sign with your logo behind you to show your branding.

- When sharing your screen, make sure your browser tabs, favorites as well as your PC desktop are cleaned up (it's easy to hide your bookmark bar). Remember that when you are sharing your screen, your clients can see what you have so be aware of this.

- Another tip when sharing your desktop in zoom, only share the browser window vs the entire desktop. This way you can look at other things that you need while your clients just see what you want them to see.

Extending your practice to include virtual can be very beneficial for you and before you know it, you just might be running most if not all of your meetings online.

Good luck and let us know if we can help.