Last month we introduced you to our "Spotlight on Cards" blog post where we showcased not only some critical cards, but also the interaction between the cards. This month we talk about the big question that many have: How can I have lots of cash on hand and yet still have a cash shortage?

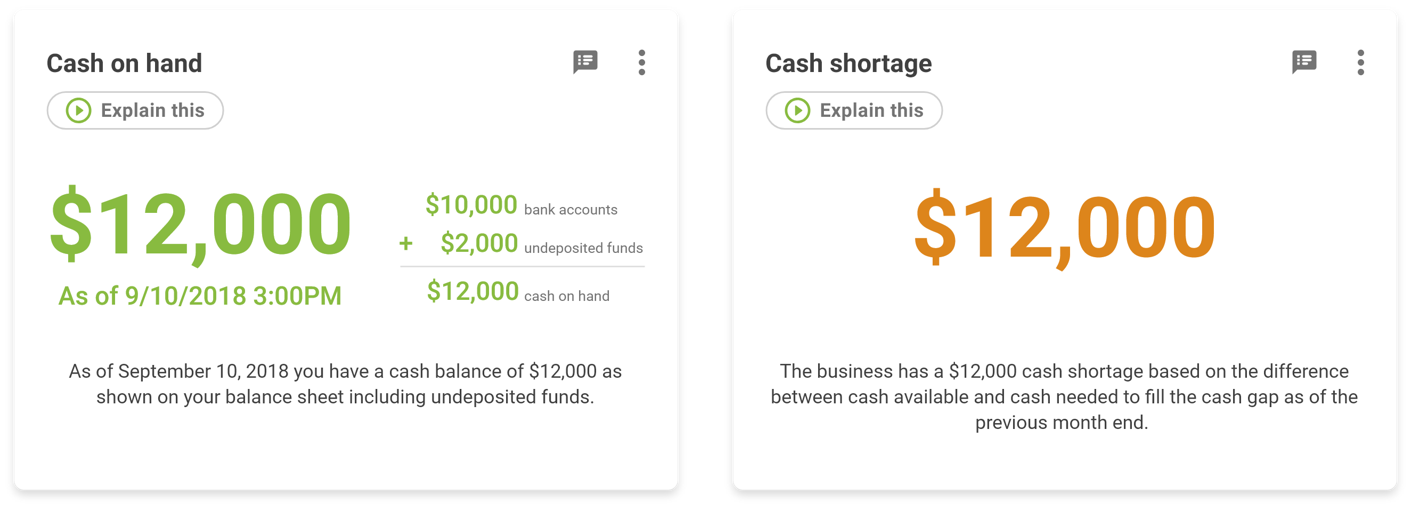

If you have used CashFlowTool’s dashboard feature, you know that we present two cards to you: Cash on hand and Cash shortage. You might see a scenario where you have cash on hand and yet still have a cash shortage. At first glance, these seem like the same thing, but in fact they are not.

Cash on hand is the total amount of accessible cash that you have in your business. This could be cash in your pocket or in your bank account. Cash on hand assumes that you have no sales. Cash shortage on the other hand shows you if you have enough cash to keep your business operating on a day to day basis. In other words, do you have enough money to keep operating during your working capital cycle which is the amount of time it takes to turn the net current assets and current liabilities into cash. Both of the cash on hand and cash shortage metrics operate separately.

Here's a deeper look on each card, a video to explain them as well as the formula:

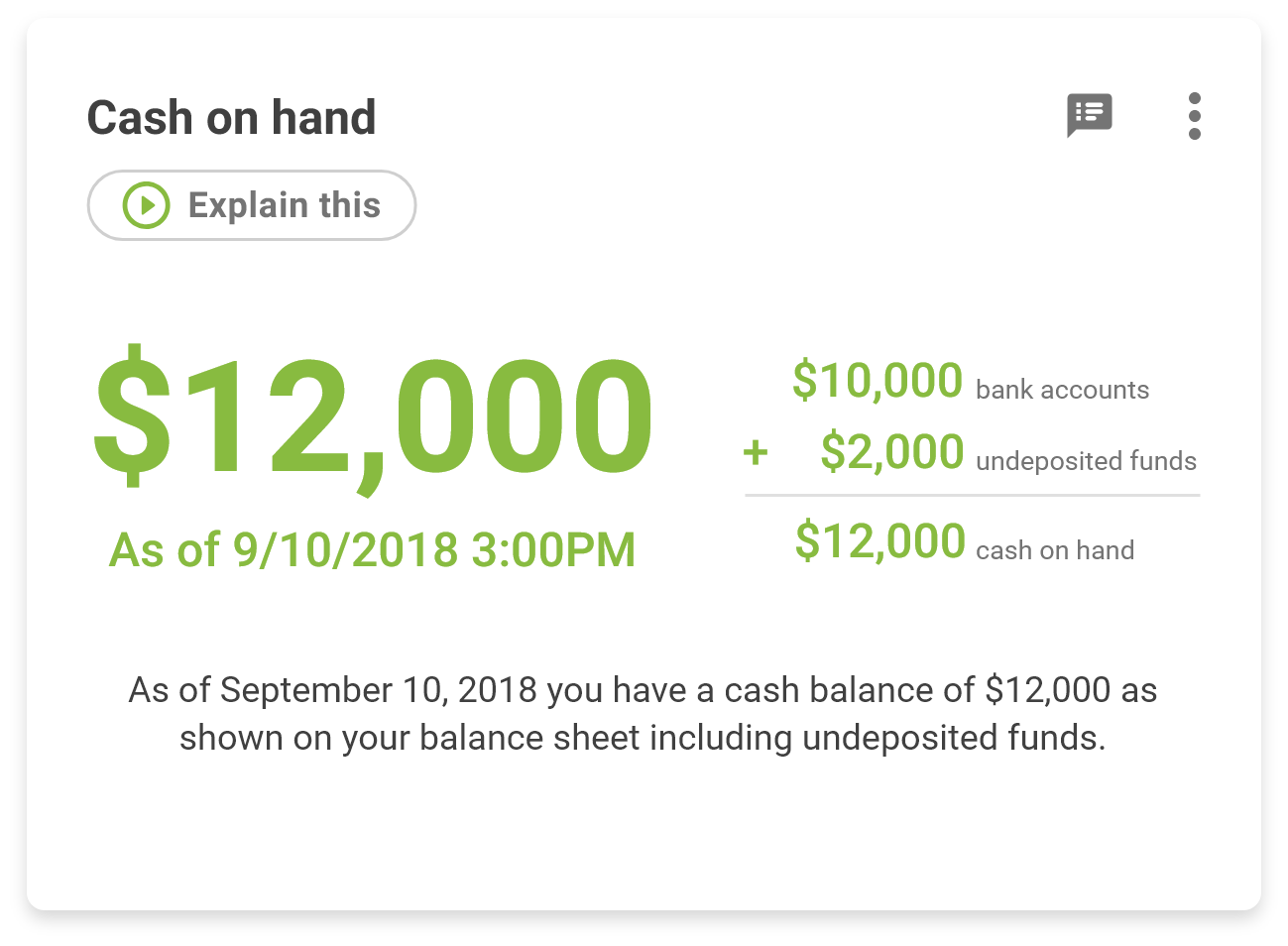

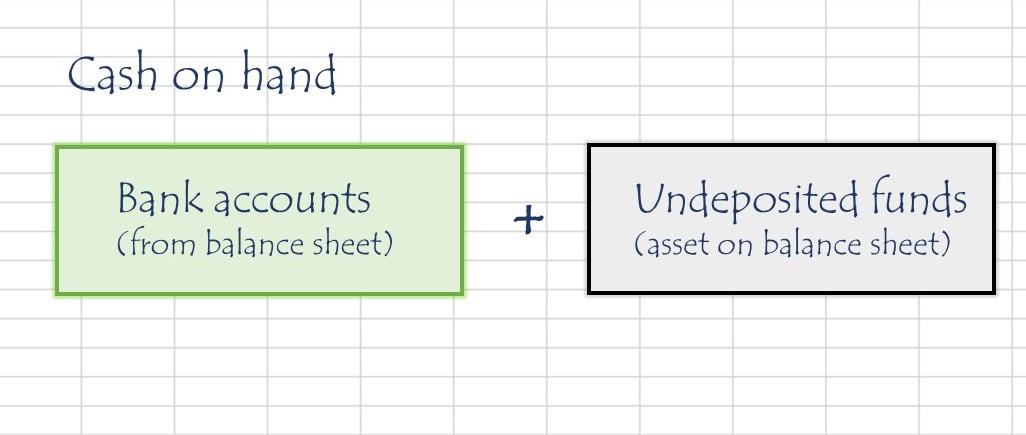

Cash on hand

| Cash on hand shows how much cash on hand do you have to pay for expenses assuming no new sales. |

|

|

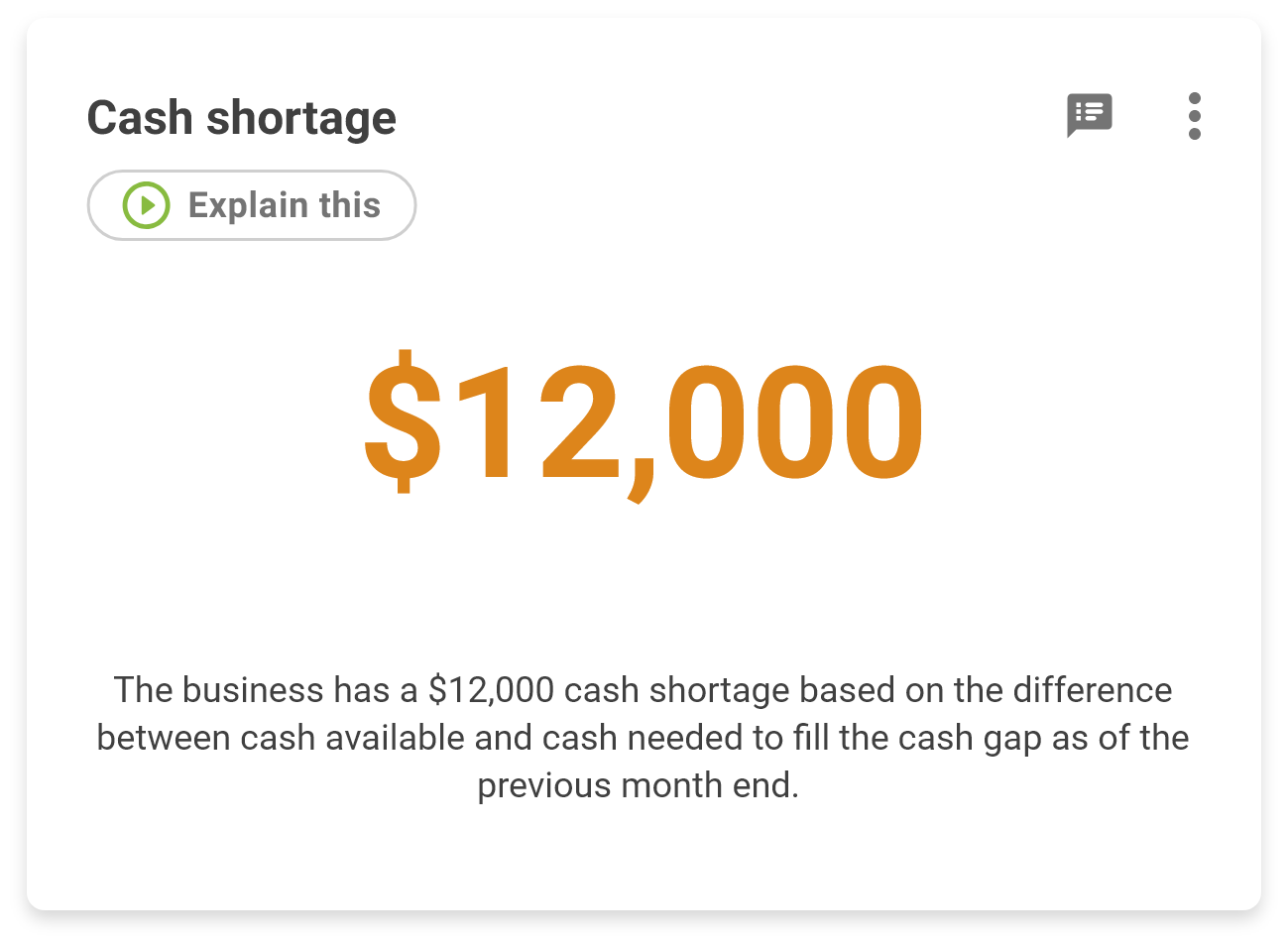

Cash Shortage

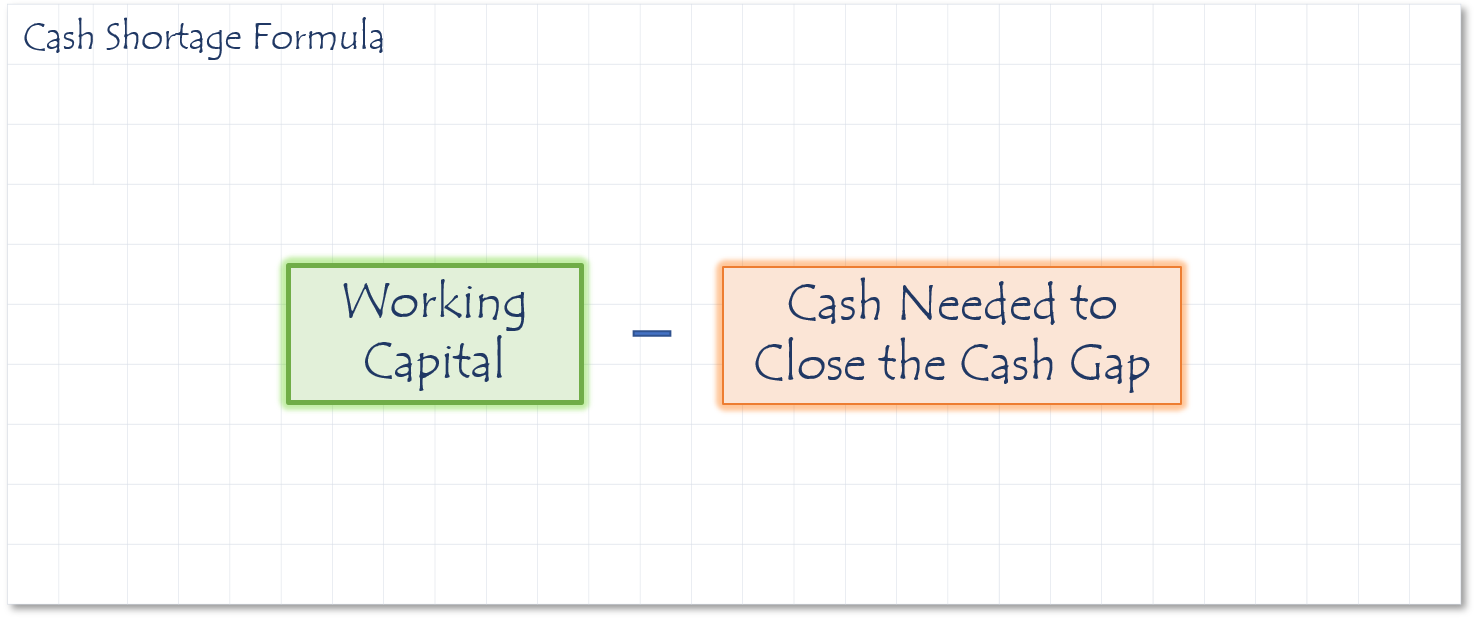

| Measures if you have enough money to keep operating during your working capital cycle. |

|

|

So there you have it! When you see these important metrics in the CashFlowTool dashboard, you will immediately understand the difference.

Next month we will explore more cards and if you have any specific requests, let us know.