CashFlowTool shows over 30 business metrics enabling you to have a quick pulse on your business. These metrics appear in the dashboard feature where you can customize dashboards to meet your specific needs. This month, we spotlight 3 cards that help you understand a cash shortage.

No business ever wants to have a cash shortage and yet there may come a time that it is unavoidable. CashFlowTool has 3 important cards that help you understand what your cash shortage is, should you have one.

Cash Shortage Defined

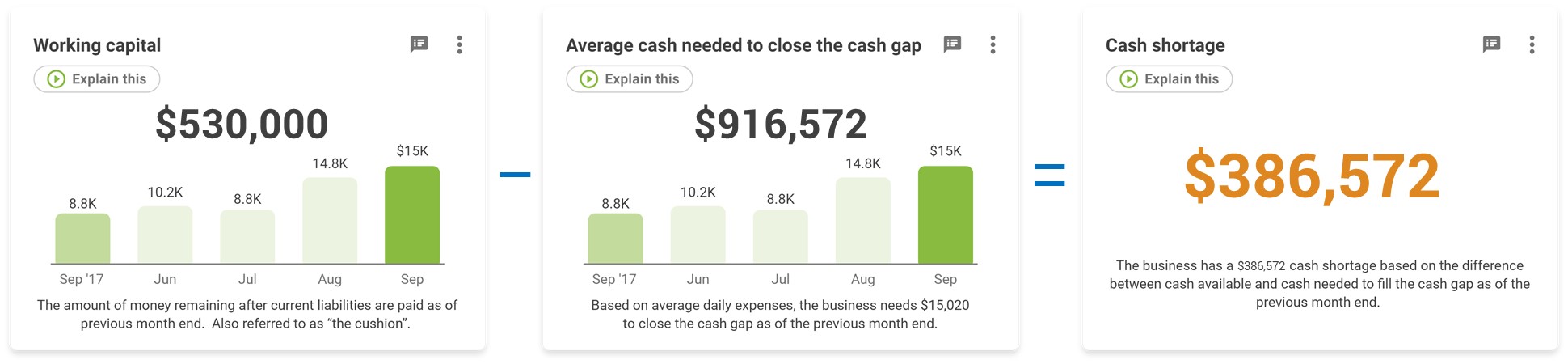

To see and understand a potential cash shortage, you use these 3 cards:

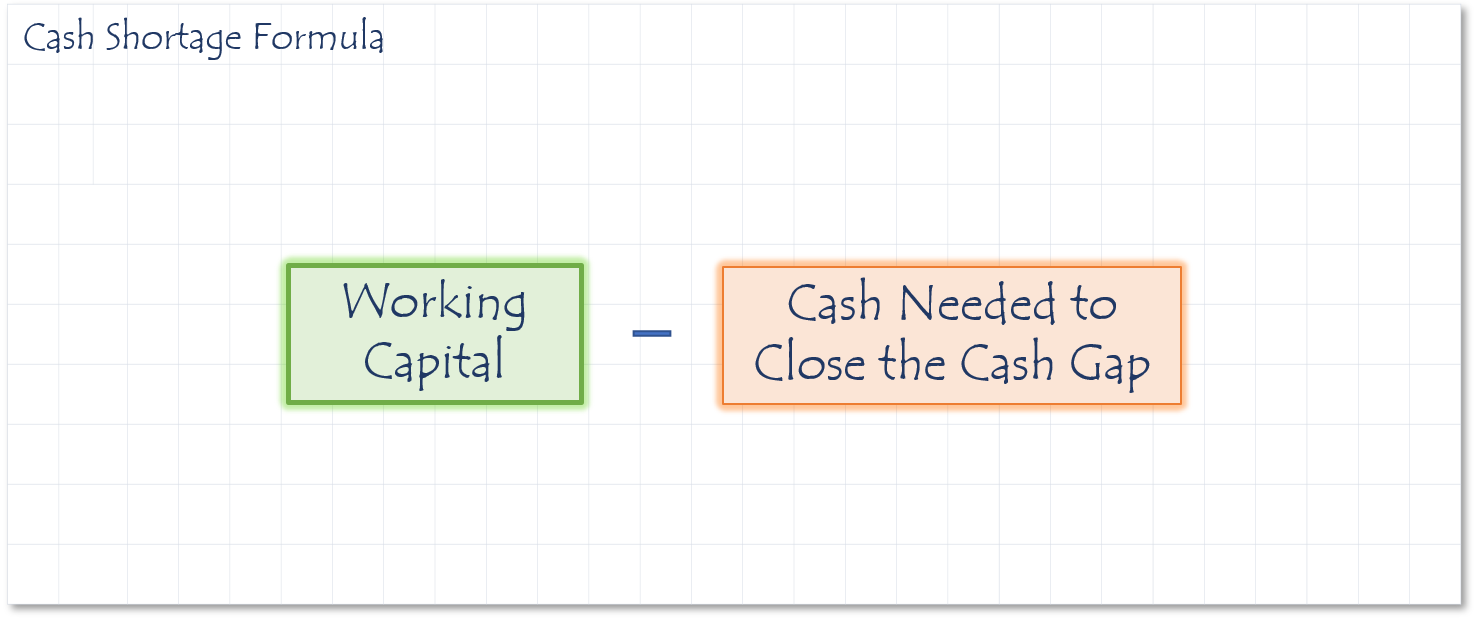

To calculate the cash shortage, you simply subtract the card "Average cash needed to close the cash gap" from Working capital. In this case, Working capital ($530,000) minus Average cash needed to close the cash gap ($916,572) equals Cash shortage (-$386,572).

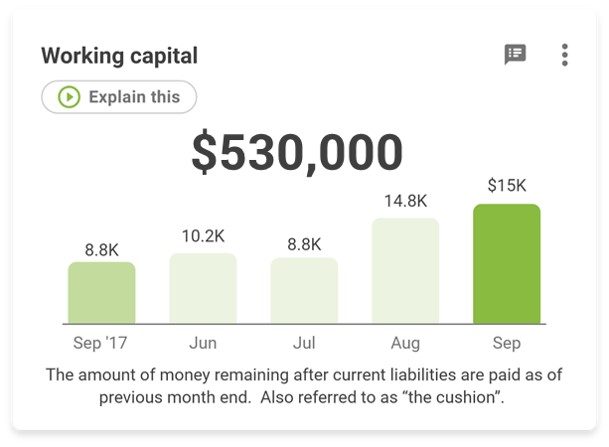

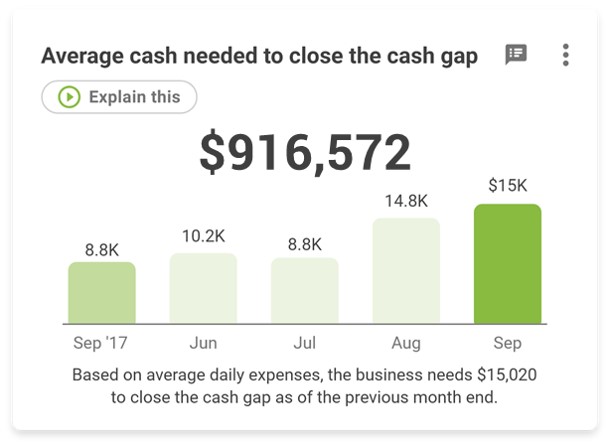

Here are the details of the calculations for each card:

Working capital

| Measures how much money you have to operate your business. |

|

|

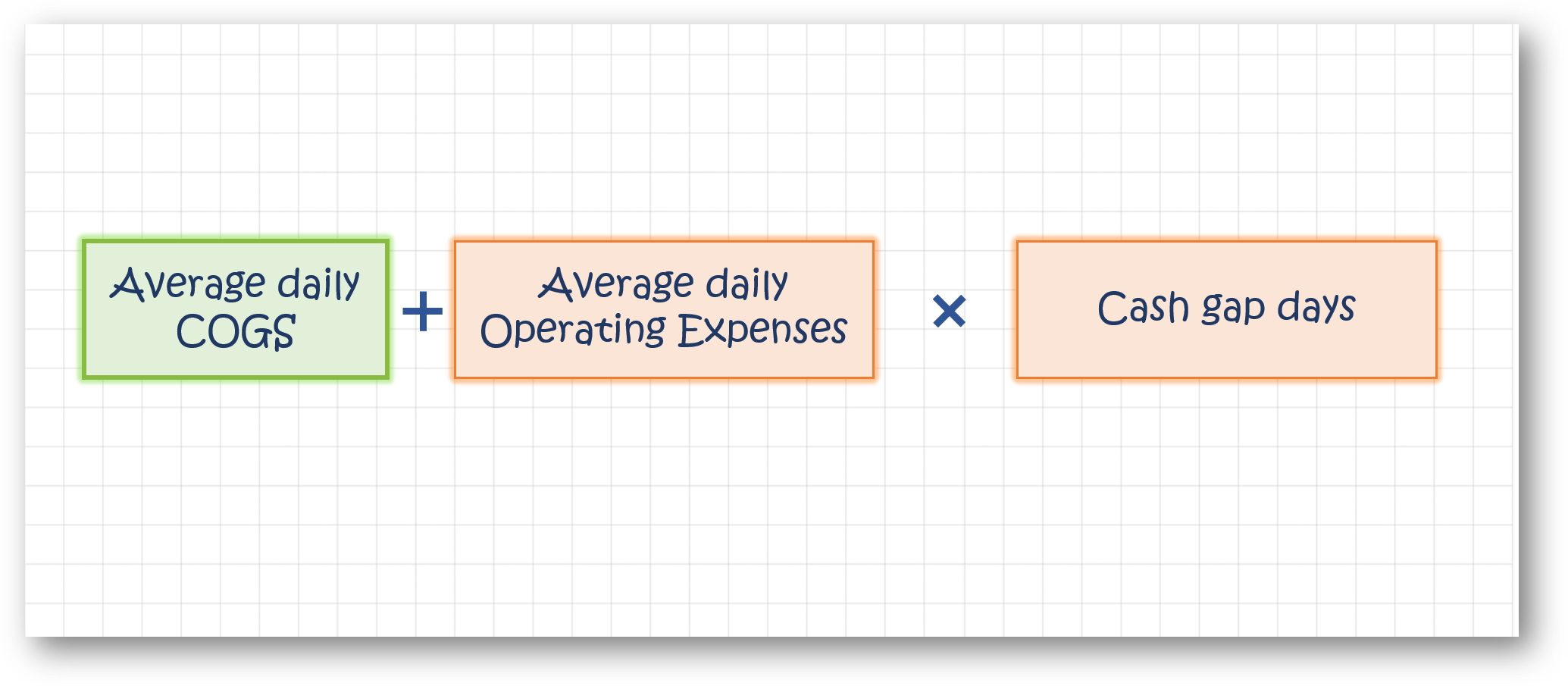

Average cash needed to close the cash gap

| The amount needed for the business to close the cash gap based on average daily expenses as of the previous month end |

|

|

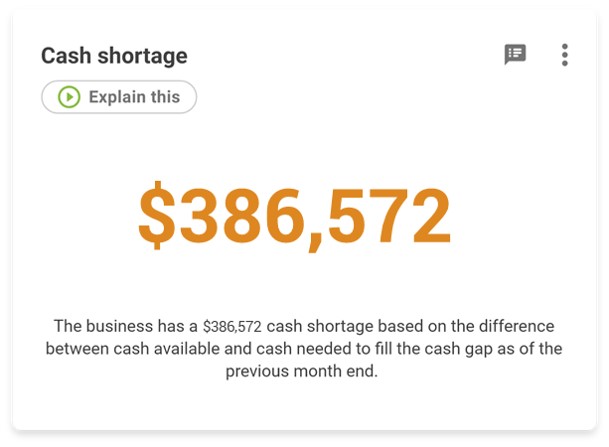

Cash Shortage

| Measures if you have enough money to sustain operations during your working capital cycle. |

|

|

So there you have it! Next month we will explore more cards and if you have any specific requests, let us know.