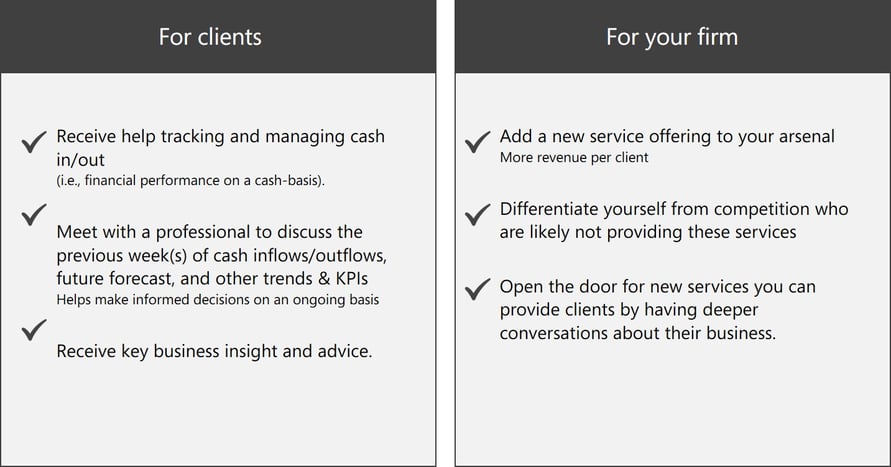

Helping your clients understand, manage and forecast cash flow is critical to their success. This also represents a significant opportunity for you to expand your capabilities and service offerings.

But where do you start? And most importantly, which clients do you start with?

If you’ve taken the time to research, invest, and develop yourself to provide these new service offerings, chances are you already have some clients in mind. But what characteristics do those first clients share? And how do you identify the right clients beyond that first group?

The framework we describe here will help you do just that.

Focus on Maximizing Your Investment

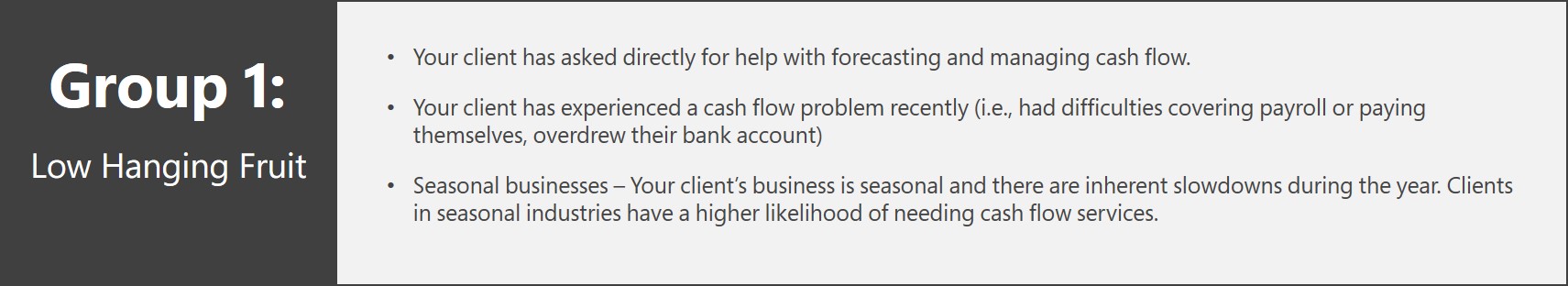

The first inclination of many professionals is to provide cash flow services only to their existing clients who are really struggling with cash flow (i.e., having trouble covering payroll or getting a loan). While that’s certainly not wrong (as these are the clients who likely need the most help), challenge yourself to look at it from a different angle.

It takes an investment of time, money, and resources to launch and execute a new service offering. And that’s exactly what you should be focused on when you begin providing cash flow services to any client … how can I maximize my investment by providing value to my firm AND developing new value for clients?

It takes an investment of time, money, and resources to launch and execute a new service offering. And that’s exactly what you should be focused on when you begin providing cash flow services to any client … how can I maximize my investment by providing value to my firm AND developing new value for clients?

It should go without saying that if you are only focused on the first few clients who come to mind, you are not maximizing your investment.

So, what's the real opportunity and value?

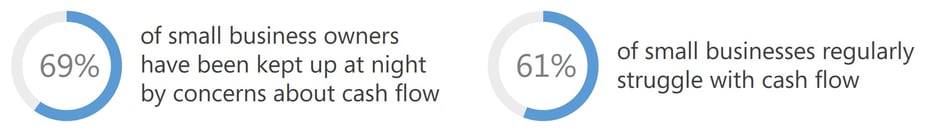

According to Intuit’s State of Small Business Cash Flow report this year, virtually every business struggles with cash flow:

Think about it from this perspective

What would providing a new service to 60+% of your client base do for your firm? Let’s get started.

Current Clients

Start with pulling together your current list of clients.

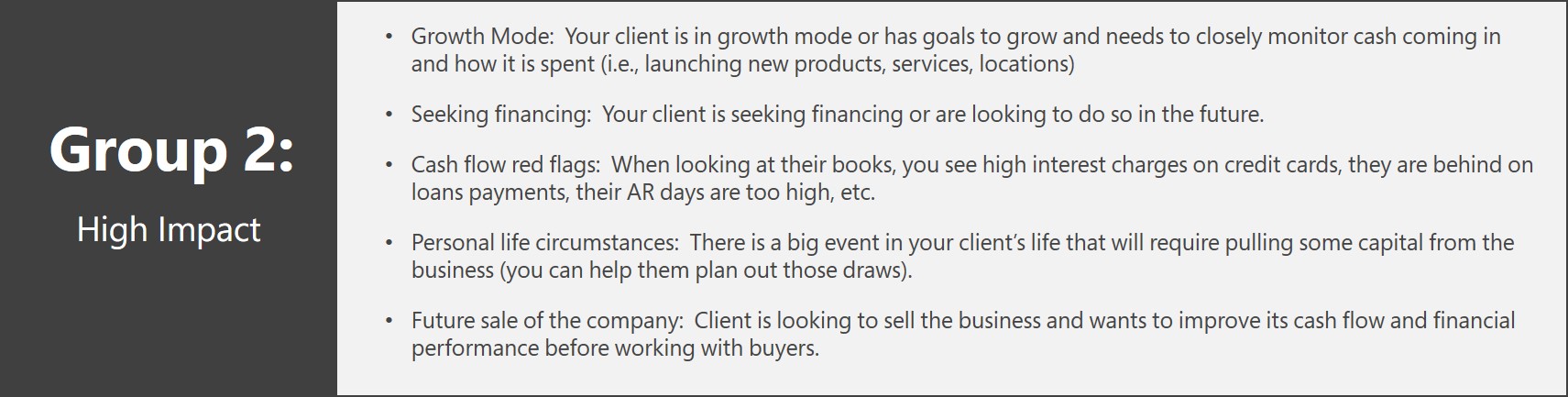

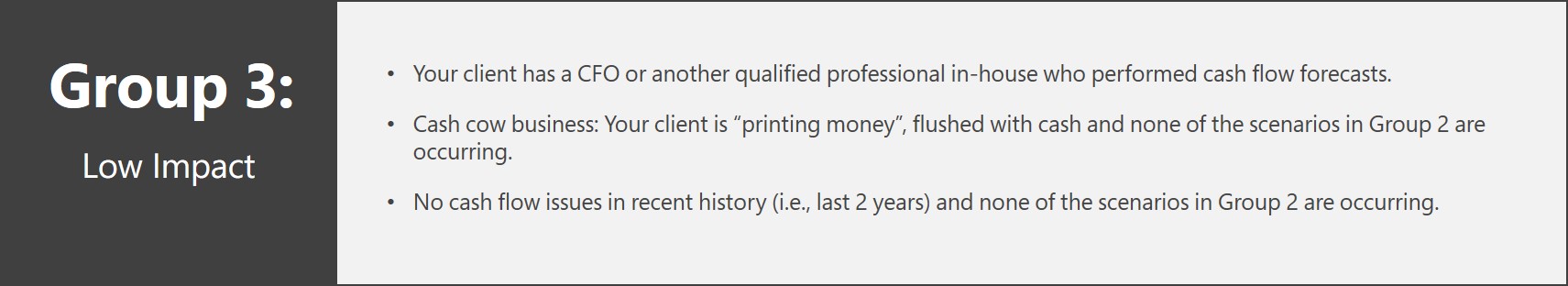

Next, we are going to put your clients into three groups based on certain attributes that indicate they may benefit from the services. These include financial metrics, info about their business and operations, and information they have communicated to you.

Under each group below, you will find examples of these attributes to help put your clients into each group.

We call groups 1 and 2 your “shortlist”. These are the clients who will benefit from your new cash flow services the most. When you communicate the value cash flow services provide to them, be sure to focus on the specific characteristics listed above (or others) that made you target them in the first place.

For group 3, be sure to let them know these services are available to them. You never know what circumstances may change in their business that could lead them to become a group 1 or group 2 client.

New Clients

This one is simple. Include cash flow services in every new proposal

As you speak with prospects and learn about their business, ask questions to help place them into group 1, 2 or 3. If they fall into group 1 or 2, include cash flow services directly into your proposals along with the ‘standard’ service offerings you provide clients (i.e., bookkeeping, payroll).

Here are some example questions to get you started and uncover their needs:

-

What information do you typically use to make business decisions like hiring a new employee, buying a new piece of equipment, or taking on a new client/project?

-

What process do you go through to ensure you have enough cash to pay ongoing expenses (i.e., payroll, rent, suppliers) without any long-term goals such as expanding your business through a new location, investments in marketing, other areas, etc.?

-

What are your financial goals for the business over the next couple of years?

-

Have there been any situations in the last couple of years where the amount of cash in the bank has prevented you from satisfying obligations (i.e., payroll, debt) or executing plans to grow?

-

How much are you paying in bank fees or interest charges per year?

-

Have you (the owner) been able to pay yourself consistently or are you drawing out cash sporadically as it becomes available?

Conclusion

Remember, in order to take full advantage of the opportunity to provide cash flow services to clients, you need to focus on both your existing and new clients.

Now who we know who to target, what’s next? Execution.

CashFlowTool will help you not only execute on cash flow services with clients, but also help you do so profitably by automatically producing the reports and metrics you need from QuickBooks instead of preparing these manually.

Interested in learning more? Hear from some of CashFlowTool’s Partners who are doing this already with their clients.