How do you grow your business and provide additional value to your clients without adding heavy costs that hurt your profit?

Building a bookkeeping business has changed over the years. It used to be that clients would drop off a bag of receipts and you would sort through them hoping you had everything you needed. Today, clients are linking their accounting software to their bank accounts, expecting the bookkeeping to be so simple, that even they can do it.

So how do you grow your business and provide additional value to your clients without adding heavy costs that hurt your profit?

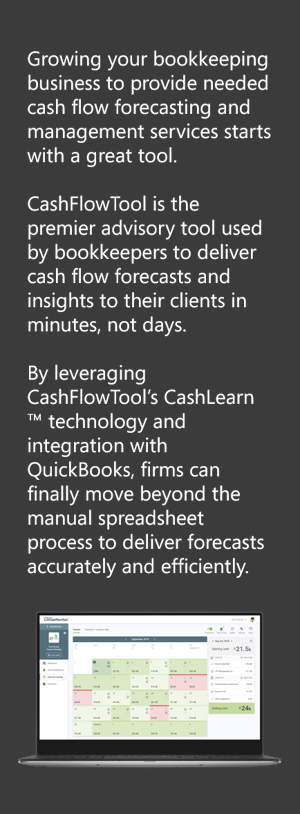

By adding cash flow advisory services – forecasting and management. This revenue stream keeps you relevant and irreplaceable from your client’s perspective.

Let’s talk about perspective. Steve Young, the famous NFL quarterback said “Perception is reality. If you are perceived to be something, you might as well be it because that’s the truth in people’s minds.”

Do you really want to be perceived as just providing bookkeeping services? Going beyond basic bookkeeping services to reporting and adding insights demonstrates to your clients that you can be trusted to help them make better business decisions. And when you can give them recommendations to manage cash flow better, the perception of you changes. You can change their reality of you and the services you provide.

When you change the perspective, you can also change your position. From one who provides necessary services to one who is essential to the growth and health of your client’s business.

Want to have those necessary conversations with you clients? Here are some ideas to start:

Even if they don’t have a formal budget, they do have an idea of where they would like sales to be on a monthly basis and what they would like the bank balance to be. CashFlowTool can show both key performance indicators to them quickly in a dashboard so they know they are on track to meet their targets.

Good cash flow forecasting and management comes from a deeper understanding of the activities that drive costs in the business. The four foundational pillars of every business are marketing, sales, operations and finance/administration. You see the detailed activity with the accounting services. Why not match what you learn to the story the finances tell.

You spend a lot of time in their books. Review the balance sheet and income statement with them. Even if you don’t have regularly scheduled meetings with them email them the balance sheet and income statement with some notes of how they can improve gross profit margins and net profit. CashFlowTool puts that information right at your fingertips.

What would your client pay to know how long it is taking their customers to pay them? What about knowing how long the cash they have on hand will last? What about those unexpected costs that come up because they thought they had more cash than what was really available? What if you could tell them when they could hire a new employee or purchase a new asset? CashFlowTool gives you the information in a format that allows you to easily share those insights.

Want to know more about CashFlowTool? Schedule a demo and business building discovery session today!

Visit CashFlowTool.com/Accountants

Download PDF of this article here